What is a good credit score?

Aa credit score between 600 and 700 will generally be considered good, while a score of 800 or above will be considered excellent. In Australia, credit scores are calculated by credit reporting agencies in different ways, so the scores may vary slightly.

A good credit score indicates you are a responsible borrower and may increase your chances of being approved for credit, with better interest rates.

Keep in mind lenders also consider other factors, such as your income, employment history, and how much other debt you have, when making credit decisions. It's important to check your credit report regularly and address any errors or inaccuracies to maintain a good credit score.

Here's the full breakdown of the credit score ranges from Australia's three main credit reporting companies and how they label them.

Credit score ranges in Australia

| Equifax | Experian | illion |

|---|---|---|

Excellent: 853-1,200 | Excellent: 800-1000 | Excellent: 800-1000 |

Very good: 735-852 | Very good: 700-799 | Great: 700-799 |

Good: 661-734 | Good: 625-699 | Good: 500-699 |

Average: 460-660 | Fair: 550-624 | Room for improvement: 300-499 |

Below average: 0-459 | Below average: 0-549 | Low score: 1-299 |

What do lenders view as a good credit score?

The credit score ranges used by credit reporting companies are a helpful guide. But even when you check your credit score that's not necessarily the same as knowing what's ‘good’ in a lender’s eyes.

Money.com.au’s database spans hundreds of Australian lenders and, trust us, a good credit score can mean quite different things depending on which one you ask.

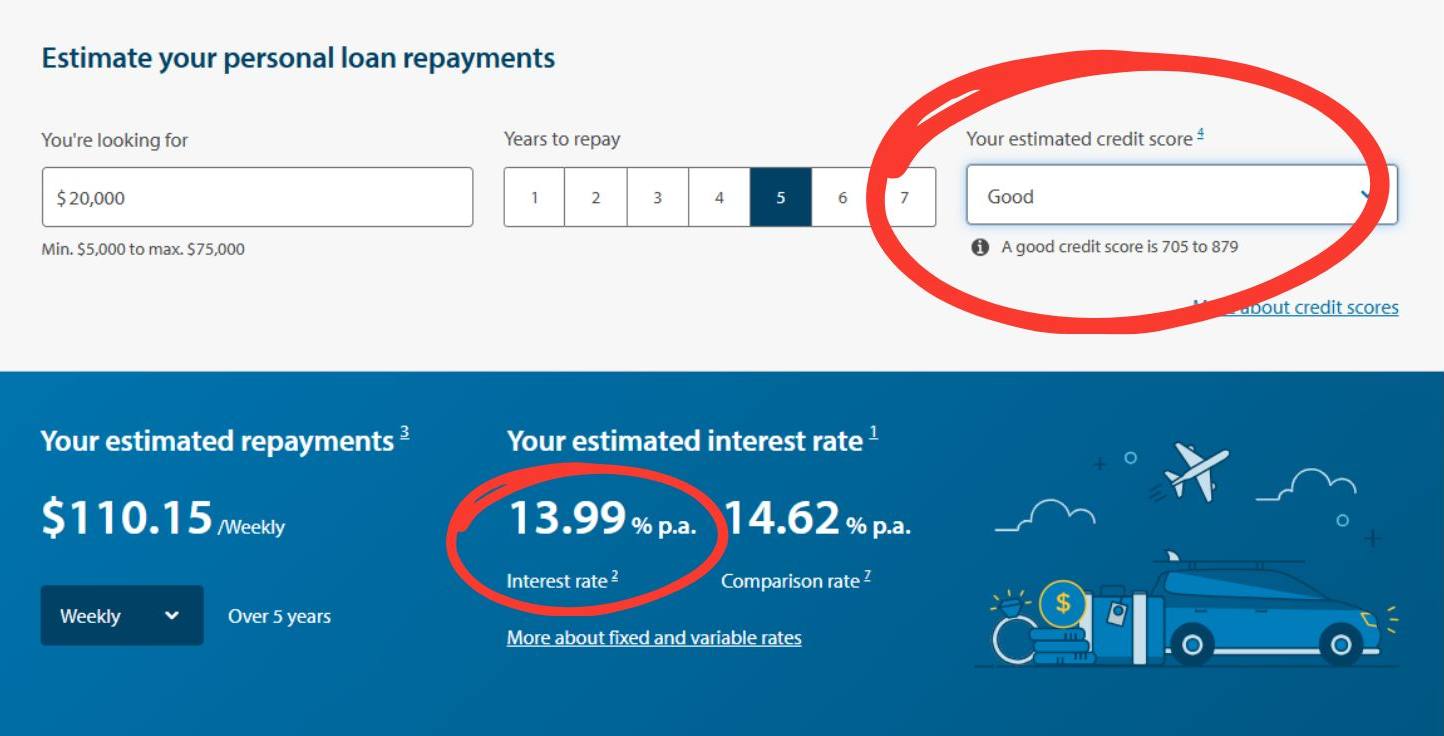

For example, when estimating interest rates on personal loans, major bank ANZ considers a credit score between 705 and 879 to be ‘good’.

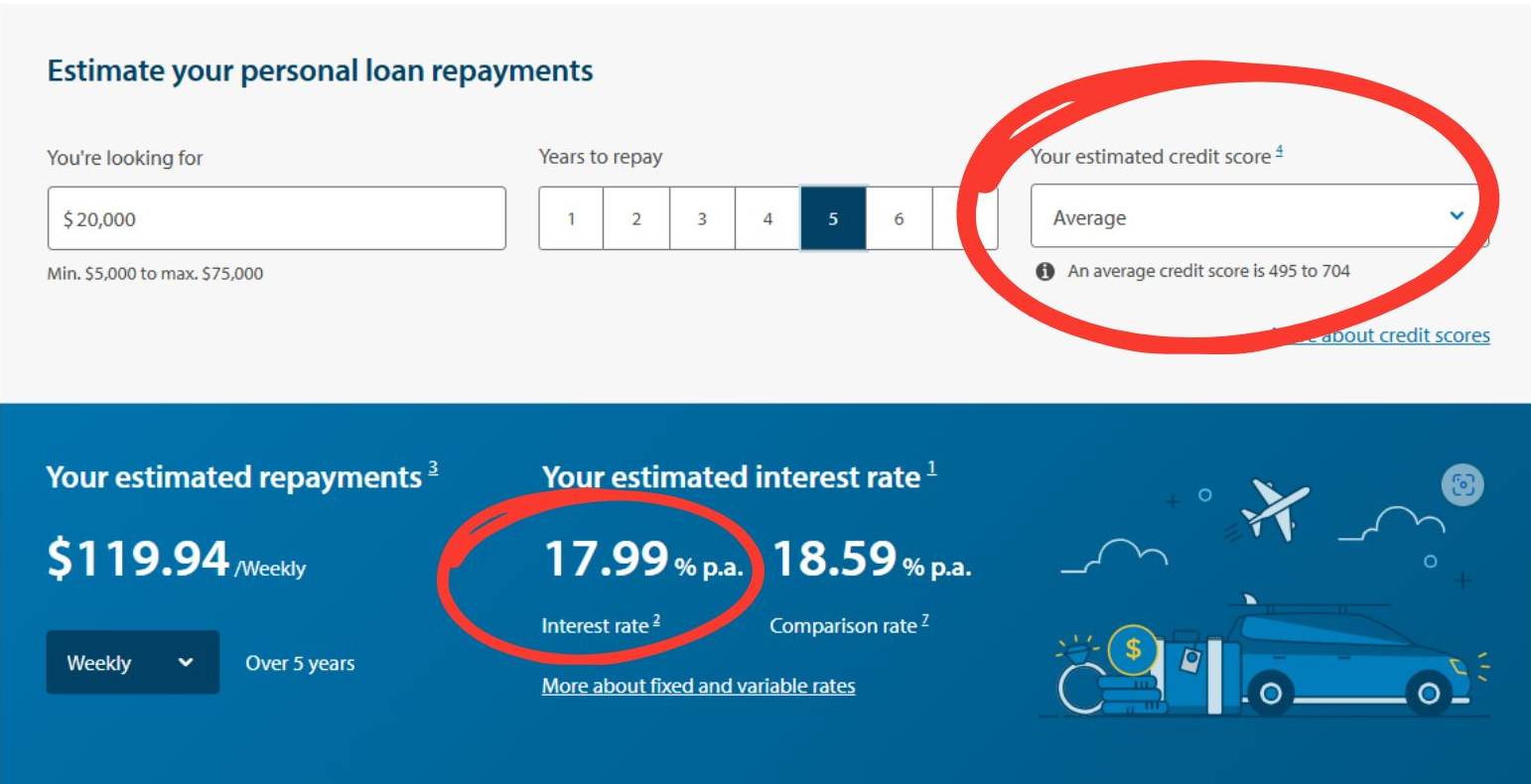

BUT if your credit score is just one point lower and falls into ANZ's 'average' range between 495 and 704, the interest rate quoted increases significantly.…

The takeaway is, it can really pay to get quotes from MULTIPLE lenders based on your credit score.

The difference between them based on very slight credit score changes (and therefore the rates they charge) can be massive.

What does having a good credit score mean?

A good credit score indicates there are no significant negative events on your credit report.

In other words, you’ve been able to repay your loans or other credit products (like credit cards) and utility bills consistently.

This is good news, because:

- You should be eligible to get a loan from most providers

- At a lower interest rate than some other borrowers

- And with a higher credit limit

You see, lenders use your credit score as part of their credit assessment criteria. And a higher credit score means less risk for the lender.

Analysis by Money.com.au found that, on average, borrowers with a ‘good’ credit score qualify for rates that are 3.66% lower than those with an ‘average’ credit score.

Having a good credit score (and getting a better interest rate) can mean being able to repay your debt sooner, which can be good for your overall financial health.

What do the other credit score ranges mean?

The exact labels used to describe them vary, but generally there are four other credit score levels:

Excellent

An excellent credit score shows lenders that you have a strong credit history. You should be able to access credit easily, including the best interest rates and favourable loan terms.

Very Good

Provided you are able to make repayments you should be able to secure finance easily with a very good credit score. You may not get rates as good as those with an excellent credit score.

Average

An average score may mean higher rates and stricter terms than very good and excellent scores, but in most cases, you should still be able to secure finance.

Low/below average

A low credit score indicates to lenders that you have bankruptcies, defaults or other negative events in your credit history. Traditional lenders may deny your applications for finance or charge you higher interest rates.

Is your credit score important in Australia?

Yes your credit score is an important aspect of your financial position, as it indicates to lenders and other credit providers how trustworthy you are as a borrower.

Lenders use your credit score to determine whether you're eligible to access credit, and in the case of personal loans and car loans, at what interest rate.

In other words, if you have a good credit score, you're more likely to be approved for a loan, it will be cheaper to get credit and easier to pay it back.

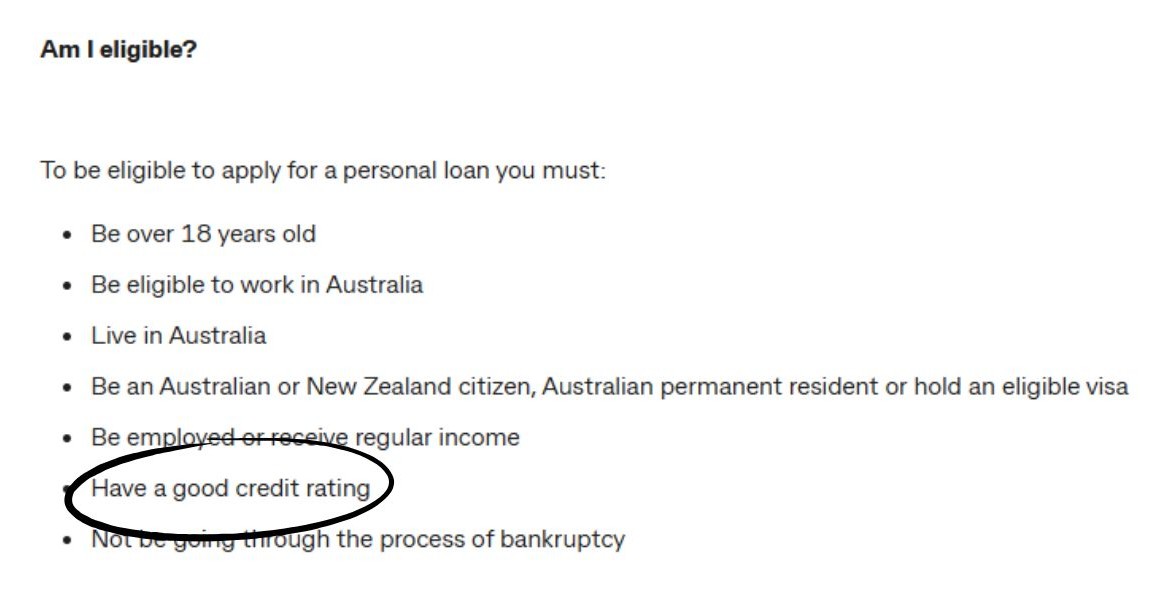

This is a fairly typical example of loan eligibility from a major bank….

What products require a good credit score?

Personal loans

Loans used for purposes like debt consolidation and home renovations will take into account your credit score when you apply. A good score makes the likelihood of approval high.

Car loans

These are secured loans (not as risky for lenders) so your credit score may be less of a factor. But some lenders (like the major banks) might still only give car loans to borrowers with a good credit score.

Credit Cards

For credit cards with a higher limit you may benefit from having a good score when you apply.

Home loans

The higher your score, the more willing a home loan provider will be to work with you.

How could a bad credit score affect me?

Having a bad credit score isn’t the end of the world. But it can make getting credit more difficult. Some lenders may even deny your application for credit.

If your application is accepted you may have to pay a higher interest rate and have more restrictive loan terms.

This is why we usually recommend borrowers work on improving their credit score before applying.

But if you have a low credit score you may still be able to access credit with lenders who specialise in bad credit personal loans, car loans or home loans.

Is my credit score affected when applying for a loan?

When you apply for a loan, the lender will need to do a credit check as part of their assessment.

There are two types of credit checks:

Hard credit checks

Made when you make an official loan application. Hard credit checks are recorded in your credit history and can impact your credit score.

Soft credit checks

Less formal, such as when you’re simply checking your credit score. These are not recorded in your credit history and do not impact your credit score.

What's the average credit score in Australia?

The average credit score among Australians is 861 according to credit reporting company Equifax. That means on average Australians have an ‘Excellent’ credit score. When broken down by gender, women (896) have a higher average credit score than men (882).

Average credit score by age in Australia

| Age group | Average credit score |

|---|---|

18-30 | 731 |

31-40 | 829 |

41-50 | 868 |

51-60 | 918 |

61-70 | 935 |

Looking across the states and territories, people in the ACT (906), Tasmania (886) and Victoria (885) have the highest average credit scores.

The lowest average credit scores were found in the Northern Territory (834) and Queensland (857).