Business statistics in Australia at a glance

- There are around 2.72m business operating in Australia.

- New South Wales has the most business (916,603) of any state or territory and the highest number of businesses per person (approx 0.105 per person).

- Construction is Australia's biggest industry in terms of the number of businesses trading (462,939).

- Healthcare and social assistance is biggest for number of people employed (2.37m).

- Only 75% of Australian businesses survive past their first year of trading.

- Around 97.3% of businesses in Australia are small businesses (0-19 employees).

- Businesses involved in non-metallic mineral mining and quarrying have the highest average profit margin (49.4%).

- Business involved in private hospitals recorded the lowest average profit margin (-0.1%).

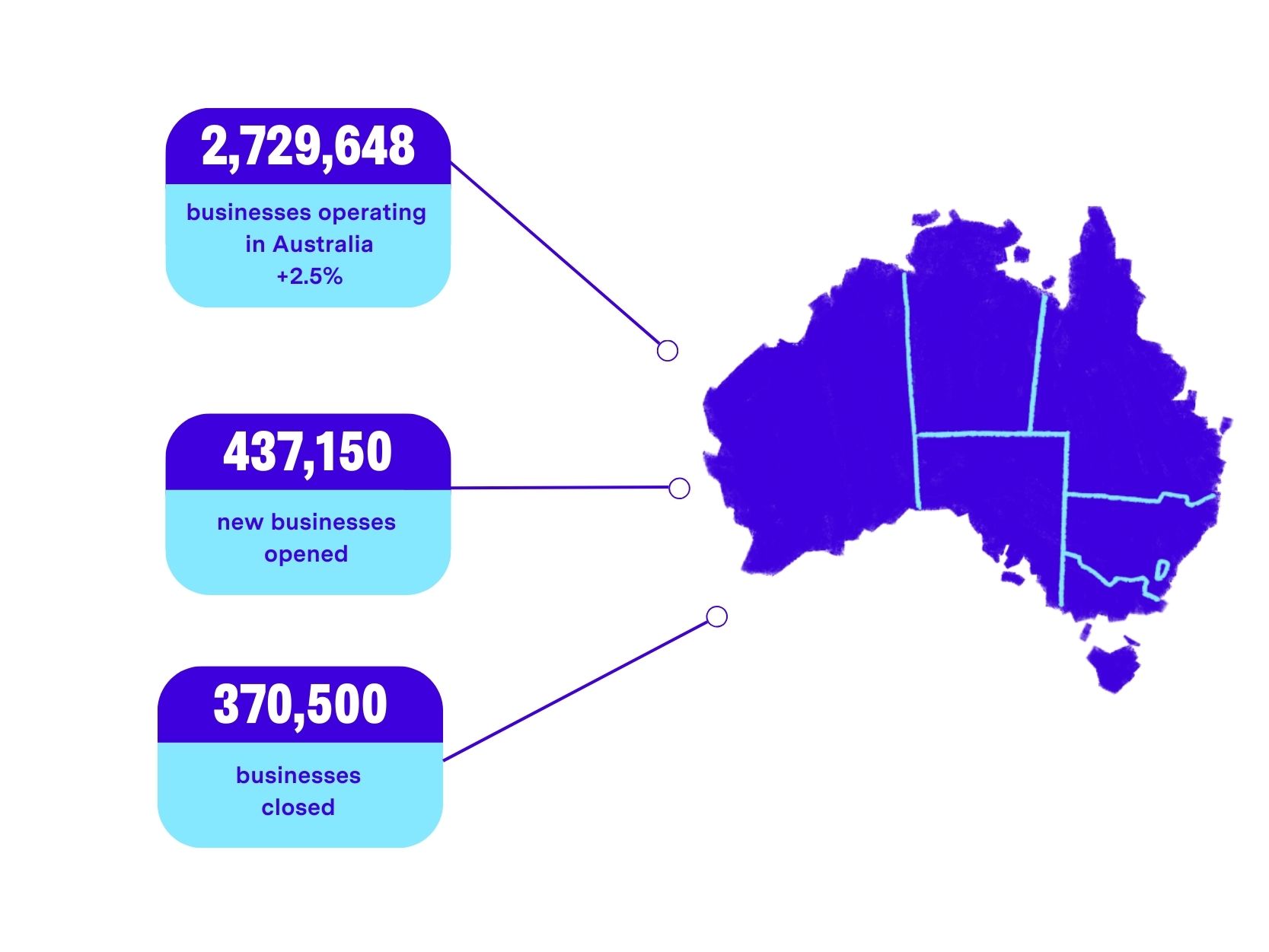

Number of businesses in Australia

Based on Australian Bureau of Statistics figures for the 2024/25 financial year.

Overall, there were 2,729,648 actively trading businesses in Australia as of 30 June 2025, according to the Australian Bureau of Statistics.

To put that into perspective, there's just shy of one Australian business for every 10 people in the country.

There was a 2.5% increase in the number of businesses operating at the end of FY 2024/25 compared to the start of the year, or 66,650 extra businesses. That rate of growth is slightly higher than it was in 2022/23 (+2.0%), but down on the 2021/22 when the growth in business numbers was twice as high (+5.6%).

Here's how the number of businesses has changed over the years...

And here's the total broken down by type of business.

The company structure dominates (44%), followed by sole proprietors (30%), trusts (18%), then partnerships (8%).

The remainder (only 398) are public sector businesses.

According to Dr Pratiti Chatterjee, Senior Lecturer in Economics at the University of Western Australia, new businesses opening in large numbers is encouraging to see in the short term, but doesn't necessarily translate to longer-term growth.

“After three or five years, you probably see that a lot of these businesses have exited the economy due to the fact that they're not sufficiently productive or adding as much value as was expected,” she said.

“In terms of a very broad picture, smaller businesses are really having a tougher time.

“The hospitality sector in particular is seeing dwindling profit margins, coupled with the fact that households have tight budget constraints right now, which means room for discretionary spending is lower.”

The challenges facing many Australian businesses are reflected in the increasing number of companies entering external administration, rising by 39.2% between FY 2022/23 and FY 2023/24.

Of course, some sectors of the economy can weather turbulence better than others.

Let's look at the current industry-by-industry business number breakdown.

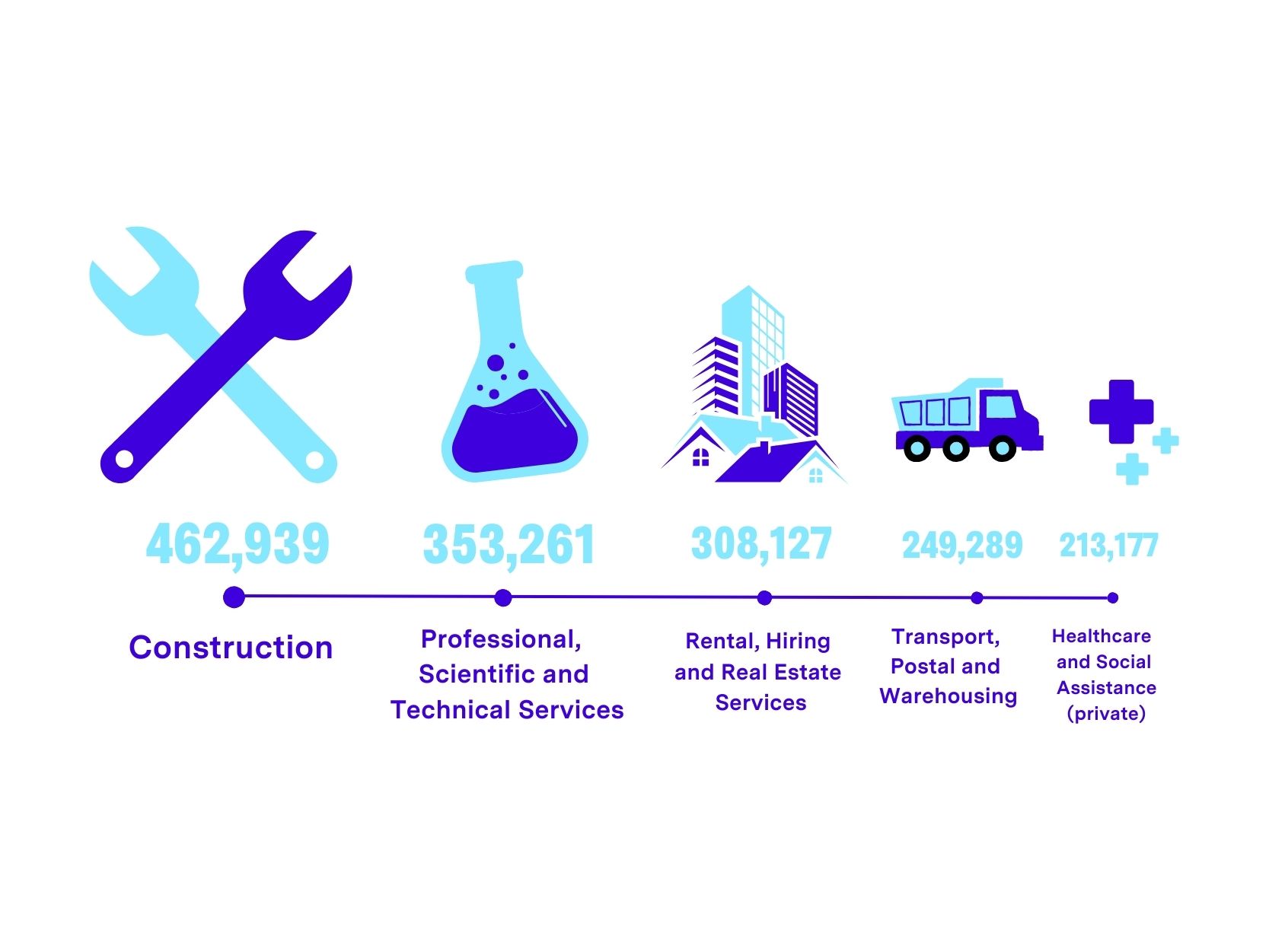

Industry-by-industry business statistics

Construction remains Australia's largest industry by number of businesses operating. It grew by 2.2% (+10,002 businesses) in 2024-25.

Transport, Postal and Warehousing (+5.1%), Health Care and Social Assistance (+6.6%), and Financial and Insurance Services (+3.7%) were the sectors with the biggest growth last year in terms of the number of businesses operating.

Agriculture, Forestry and Fishing (-0.8%) and Retail Trade (-0.4%) were the only industries to record a decline in total number of businesses operating in 2024/25.

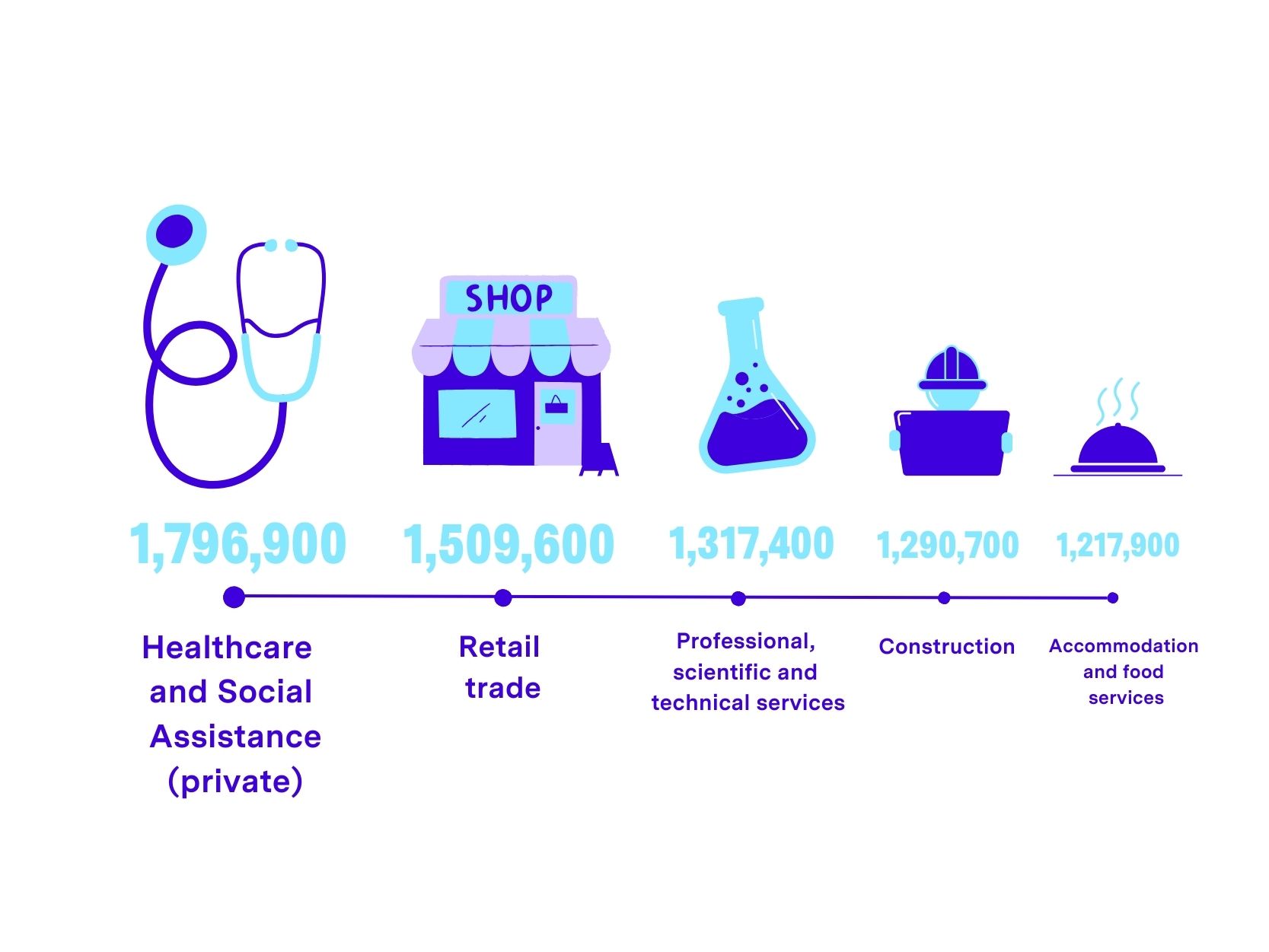

Largest industries by number of employees

The traditional industries dominate here too, with healthcare, social assistance, and retail combined making up almost 24% of Australia's workforce.

Survival rate of new businesses

The survival rate of new businesses varies significantly between industries.

On one end of the scale, just under 61.1% of agriculture, forestry and fishing businesses survived beyond three years of operating (among businesses started in the 2020/21 financial year).

At the other end, only 35.1% of transport, postal and warehousing businesses survived over the same time frame.

The overall survival rate across all industries was just under half, sitting at 40.8%.

Looking ahead, Dr Chatterjee said two of Australia's largest sectors – mining and third-level – education could be vulnerable over the coming year.

In the case of mining, China’s slowing economic growth is likely to continue impacting iron ore exports. For universities, foreign student caps will present a challenge.

According to Yanir Yakutiel, CEO of business lender, Lumi, construction is another area of concern.

"Continued RBA rate increases have put further pressure on house prices and development, with lead contractors on fixed contracts particularly exposed," he said.

But beyond these areas, there is some hope for Australian businesses that things may improve in 2025.

“When we look at forecasts by the RBA or various policy institutions, we're forecasting that we're almost at the bottom or at the bottom," Dr Chatterjee said.

"So going forward by early 2025, we do see the economy picking up, assuming that there are no other further disturbances or nothing major going on with the economy.”

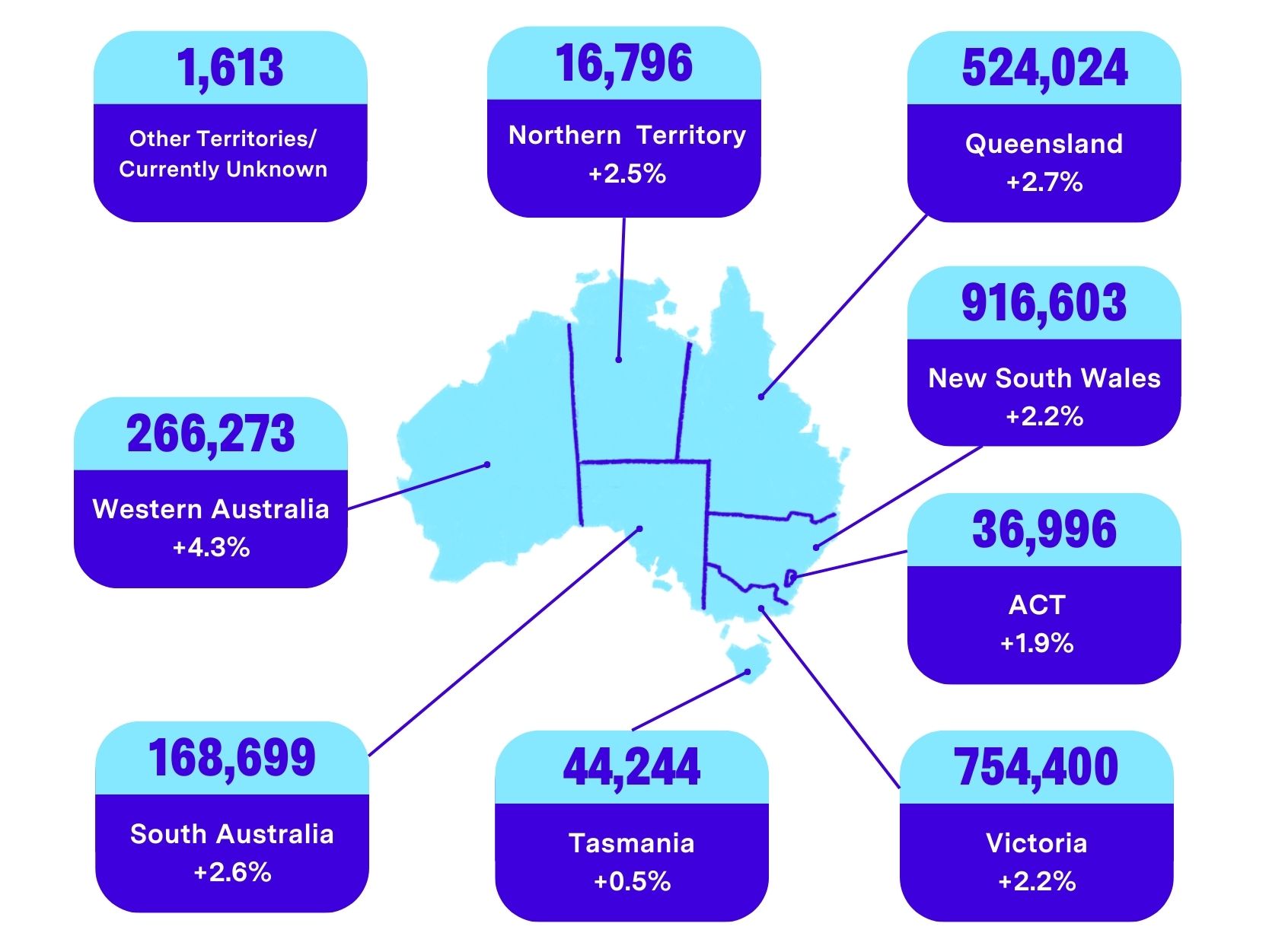

State-by-state business statistics (number of businesses operating)

Queensland and South Australia enjoyed the joint largest percentage growth in businesses operating in 2024/25.

However, New South Wales added the most new businesses in total (+20,040) and remains the state with the highest total number of businesses (916,603).

Queensland continues to be the preferred destination for businesses moving interstate, adding 1,250 new from other states last financial year.

Looking at the number of businesses per head of population, New South Wales has the highest at 0.106 businesses per person. Tasmania has the lowest at 0.076.

State-by-state churn of businesses

State/territory | New South Wales |

|---|---|

Businesses opened | 147,571 (-1.2%) |

Businesses closed | 126,475 (+3.0%) |

Net migration in/out of state | -1056 |

State/territory | Victoria |

Businesses opened | 123,428 (-.93%) |

Businesses closed | 106,858 (+1.2%) |

Net migration in/out of state | -84 |

State/territory | Queensland |

Businesses opened | 82,254(+1.7%) |

Businesses closed | 69,925 (+1.6%) |

Net migration in/out of state | 1,250 |

State/territory | South Australia |

Businesses opened | 25,135 (+0.8%) |

Businesses closed | 20,809 (+3.6%) |

Net migration in/out of state | -81 |

State/territory | Western Australia |

Businesses opened | 43,723 (+1.6%) |

Businesses closed | 33,190 (+1.6%) |

Net migration in/out of state | 344 |

State/territory | Tasmania |

Businesses opened | 5,593 (-7.6%) |

Businesses closed | 5,321 (+1.4%) |

Net migration in/out of state | -54 |

State/territory | Northern Territory |

Businesses opened | 2,786 (+1.5%) |

Businesses closed | 2,238 (-4.7%) |

Net migration in/out of state | -132 |

State/territory | Australian Capital Territory |

Businesses opened | 6,335 (-2.5%) |

Businesses closed | 5,469 (+6.4%) |

Net migration in/out of state | -187 |

State/territory | Other territories/unknown |

Businesses opened | 325 (+52%) |

Businesses closed | 215 (-3.1%) |

Net migration in/out of state | 0 |

| State/territory | Businesses opened | Businesses closed | Net migration in/out of state |

|---|---|---|---|

New South Wales | 147,571 (-1.2%) | 126,475 (+3.0%) | -1056 |

Victoria | 123,428 (-.93%) | 106,858 (+1.2%) | -84 |

Queensland | 82,254(+1.7%) | 69,925 (+1.6%) | 1,250 |

South Australia | 25,135 (+0.8%) | 20,809 (+3.6%) | -81 |

Western Australia | 43,723 (+1.6%) | 33,190 (+1.6%) | 344 |

Tasmania | 5,593 (-7.6%) | 5,321 (+1.4%) | -54 |

Northern Territory | 2,786 (+1.5%) | 2,238 (-4.7%) | -132 |

Australian Capital Territory | 6,335 (-2.5%) | 5,469 (+6.4%) | -187 |

Other territories/unknown | 325 (+52%) | 215 (-3.1%) | 0 |

How many small businesses are there in Australia?

The business sector in Australia is dominated by SMEs (small and medium enterprises). In fact, 97.2% of all business in Australia (just under 2.6 million) are small businesses (0-19 employees) and a further 2.4% are medium businesses (67,857), employing 20-199 employees.

The remaining 0.2% of businesses in Australia have more than 200 employees.

Among the population of small businesses, 63.5% do not have any employees, 25.2% employ between 1-4 people and 8.5% employ between 5-19 people.

But overall, large businesses employ more people (4.376 million) than any other type of business.

Business finance statistics: earnings and profitability

Mining remains comfortably Australia's largest industry by earnings ($232.9 billion in 2023-24), growing by more than 23% compared to the previous year.

This sector was aided by shortages in energy commodities in Europe and strong demand in Asian markets through 2022, according to the ABS.

Earnings in construction, manufacturing and retail trade also increased, albeit by much more modest amounts. Of the highest-earning industries rental, hiring and real estate services was the only one to experience a drop earnings, -0.7% compared to the previous year.

Most profitable businesses in Australia

| Business sector | Profit margin |

|---|---|

Non-metallic mineral mining and quarrying | 48.4% |

Metal ore mining | 40.1% |

Oil and gas extraction | 38.6% |

Creative and performing arts activities | 27.1% |

Medical and other health care services (private) | 27.8% |

Coal mining | 24.1% |

Property operators and real estate services | 23.4% |

Finance and insurance services | 20.7% |

Professional, scientific and technical services | 20.7% |

Rental and hiring services (except real estate) | 20.6% |

Fishing, hunting and trapping | 20.5% |

Forestry and logging | 16.7% |

Agriculture, forestry and fishing support services | 13.6% |

“Operating profit results were mixed at an industry level as many businesses faced the challenge of higher input costs in 2022-23," said Robert Ewing, ABS head of business statistics.

“Businesses experienced a mix of conditions including higher input costs, increased demand due to higher migration and a rise in non-discretionary spending due to the end of COVID-19 restrictions."

According to the ABS, industries benefitting from these factors, included the retail industry, wholesale industry, transport and accommodation and food services.

On the other hand, the rental, hiring and real estate services industry was negatively impacted by the Reserve Bank of Australia’s actions to reduce inflation by raising the cash rate

What about the least profitable industries?

Exploration and other mining support services (-6.8%) and water transport were the only two sectors recording a negative profit margin, while several other sectors operated under wafer-thin positive margins.

Least profitable businesses in Australia

| Business sector | Profit margin |

|---|---|

Hospitals (private) | -0.1% |

Primary metal and metal product manufacturing | 2.2% |

Exploration and other mining support services | 2.3% |

Aquaculture | 2.5% |

Fuel retailing | 2.5% |

Water transport | 3.1% |

Basic chemical and chemical product manufacturing | 3.2% |

Library and other information services | 3.4% |

Pulp, paper and converted paper product manufacturing | 4.0% |

Rail transport | 4.1% |

Grocery, liquor and tobacco product wholesaling | 4.1% |

Food retailing | 4.4% |

Food product manufacturing | 4.7% |

Telecommunications services | 4.8% |

Telecommunications services | 4.8% |

Motor vehicle and motor vehicle parts wholesaling | 4.9% |

Business financials by industry

Industry | Agriculture, forestry and fishing |

|---|---|

Earnings ($million)* | $17,467 |

Profit margin | 9.1% |

Businesses made a profit/broke even | 71.0% |

Businesses made a loss | 30.0% |

Industry | Mining |

Earnings ($million)* | $232,943 |

Profit margin | 34.4% |

Businesses made a profit/broke even | 51.5% |

Businesses made a loss | 48.5% |

Industry | Manufacturing |

Earnings ($million)* | $47,072 |

Profit margin | 6.4% |

Businesses made a profit/broke even | 75.0% |

Businesses made a loss | 25.0% |

Industry | Finance and insurance services |

Earnings ($million)* | $14,029 |

Profit margin | 20.6% |

Businesses made a profit/broke even | 81.2% |

Businesses made a loss | 18.8% |

Industry | Electricity, gas, water and waste services |

Earnings ($million)* | $34,922 |

Profit margin | 8.1% |

Businesses made a profit/broke even | 74.0% |

Businesses made a loss | 26.0% |

Industry | Construction |

Earnings ($million)* | $63, 412 |

Profit margin | 9.1% |

Businesses made a profit/broke even | 79.4% |

Businesses made a loss | 20.6% |

Industry | Wholesale trade |

Earnings ($million)* | $47,268 |

Profit margin | 5.6% |

Businesses made a profit/broke even | 70.6% |

Businesses made a loss | 29.4% |

Industry | Retail trade |

Earnings ($million)* | $50,191 |

Profit margin | 5.8% |

Businesses made a profit/broke even | 76.3% |

Businesses made a loss | 23.7% |

Industry | Accommodation and food services |

Earnings ($million)* | $17,407 |

Profit margin | 7.5% |

Businesses made a profit/broke even | 67.6% |

Businesses made a loss | 32.4% |

Industry | Transport, postal and warehousing |

Earnings ($million)* | $41,659 |

Profit margin | 18.6% |

Businesses made a profit/broke even | 89.4% |

Businesses made a loss | 10.6% |

Industry | Information media and telecommunications |

Earnings ($million)* | $23, 606 |

Profit margin | 3.3% |

Businesses made a profit/broke even | 73.9% |

Businesses made a loss | 26.1% |

Industry | Rental, hiring and real estate services |

Earnings ($million)* | $69,508 |

Profit margin | 22.7% |

Businesses made a profit/broke even | 80.3% |

Businesses made a loss | 19.7% |

Industry | Professional, scientific and technical services |

Earnings ($million)* | $41,475 |

Profit margin | 18% |

Businesses made a profit/broke even | 83.6% |

Businesses made a loss | 16.4% |

Industry | Administrative and support services |

Earnings ($million)* | $13,558 |

Profit margin | 8.3% |

Businesses made a profit/broke even | 84.0% |

Businesses made a loss | 16.0% |

Industry | Public administration and safety (private) |

Earnings ($million)* | $1,681 |

Profit margin | 8.1%% |

Businesses made a profit/broke even | 75.4% |

Businesses made a loss | 24.6% |

Industry | Education and training (private) |

Earnings ($million)* | $7,027 |

Profit margin | 9.2% |

Businesses made a profit/broke even | 77.6% |

Businesses made a loss | 23.4% |

Industry | Health care and social assistance (private) |

Earnings ($million)* | $36,996 |

Profit margin | 15.6% |

Businesses made a profit/broke even | 85.1% |

Businesses made a loss | 14.9% |

Industry | Arts and recreation services |

Earnings ($million)* | $7,212 |

Profit margin | 10.5% |

Businesses made a profit/broke even | 79.6% |

Businesses made a loss | 20.4% |

Industry | Other services |

Earnings ($million)* | $6,115 |

Profit margin | 10.1%% |

Businesses made a profit/broke even | 75.2% |

Businesses made a loss | 24.8% |

Industry | Overall |

Earnings ($million)* | $784,776 |

Profit margin | 14.5% |

Businesses made a profit/broke even | 79.3% |

Businesses made a loss | 20.7% |

| Industry | Earnings ($million)* | Profit margin | Businesses made a profit/broke even | Businesses made a loss |

|---|---|---|---|---|

Agriculture, forestry and fishing | $17,467 | 9.1% | 71.0% | 30.0% |

Mining | $232,943 | 34.4% | 51.5% | 48.5% |

Manufacturing | $47,072 | 6.4% | 75.0% | 25.0% |

Finance and insurance services | $14,029 | 20.6% | 81.2% | 18.8% |

Electricity, gas, water and waste services | $34,922 | 8.1% | 74.0% | 26.0% |

Construction | $63, 412 | 9.1% | 79.4% | 20.6% |

Wholesale trade | $47,268 | 5.6% | 70.6% | 29.4% |

Retail trade | $50,191 | 5.8% | 76.3% | 23.7% |

Accommodation and food services | $17,407 | 7.5% | 67.6% | 32.4% |

Transport, postal and warehousing | $41,659 | 18.6% | 89.4% | 10.6% |

Information media and telecommunications | $23, 606 | 3.3% | 73.9% | 26.1% |

Rental, hiring and real estate services | $69,508 | 22.7% | 80.3% | 19.7% |

Professional, scientific and technical services | $41,475 | 18% | 83.6% | 16.4% |

Administrative and support services | $13,558 | 8.3% | 84.0% | 16.0% |

Public administration and safety (private) | $1,681 | 8.1%% | 75.4% | 24.6% |

Education and training (private) | $7,027 | 9.2% | 77.6% | 23.4% |

Health care and social assistance (private) | $36,996 | 15.6% | 85.1% | 14.9% |

Arts and recreation services | $7,212 | 10.5% | 79.6% | 20.4% |

Other services | $6,115 | 10.1%% | 75.2% | 24.8% |

Overall | $784,776 | 14.5% | 79.3% | 20.7% |

Of course, profitability can vary massively between different businesses in the same industry.

For example, how established a business is can be an indicator of profitability.

A Money.com.au study on business financial security found that twice as many established businesses (20%) make significant profits of over 30%, compared to young businesses (10%).

Location in Australia can also be a factor.

Just over a quarter (29%) of ACT businesses make no profit, compared with businesses in Western Australia (13%), New South Wales (13%) and Victoria (10%) according to the same Money.com.au study.

We also found that 26% of Australians would not start a business in 2025 due to the stress and uncertainty of running one. Meanwhile, 20% said they wouldn’t start a business because it’s too risky in the current economy, and 13% cited a lack of capital or resources. Additionally, 10% said they might consider starting a business, while only 8% would do so if the right opportunity came up.

Australian business lending statistics

Business lending in Australia continues to soar in 2024. Overall, outstanding finance to businesses was up almost 9% in July 2024, compared to the previous year. Lending to medium-sized businesses has seen the biggest growth in that period (+15.4%).

Business cashflow remains the main driver behind a lot of funding requirements, according to Money.com.au's business lending expert, Phil Collard.

"As an example, building, trade and construction accounts for a large portion of SMEs in Australia and these businesses are generally required to make upfront payments for materials and supplies on projects with income not being realised until certain progress/milestones during the build process," he said.

There's also been a spike in the number of businesses borrowing to pay off ATO tax debt.

"We are now seeing the tax office make good on their promise to recoup accumulated tax debts by SMEs following a reprieve during the pandemic. Business owners are now considering funding solutions in order to satisfy outstanding tax obligations."

New lending has been predominantly at variable rates – 86.9% of outstanding business finance as at June 2024.

The proportion of business finance that's on a variable rate has been creeping up steadily since July 2019 (the earliest records published by the RBA) when it was just over 78%.

Interest rates on business lending have been relatively flat in the last 12 months (to July 2024), in line with a stable cash rate, but businesses are still paying significantly higher rates than they were a couple of years ago.

The greater perceived risk of lending to smaller businesses is reflected in the high rates paid versus larger businesses.

Small business loan statistics

Now let's look specifically at lending to small businesses.

According to Money.com.au data, the average small business loan amount requested is $94,845.

Financing a business vehicle is the most common loan purpose (41%), followed by requests for businesses looking to access finance for day-to-day capital (29%). Loans for business equipment make up 10% of all requests received.

Phil said despite soft conditions in some sectors of the economy, there's been a trend towards businesses borrowing to fund growth.

"This is still being approached with caution, but SMEs are increasingly looking to scale up their business by leveraging loans to help fuel growth," he said.

"The right loan facility can be a very powerful tool to accelerate growth so be sure to have your plans clearly mapped out, including expected ROI."

This trend is reflected in the high average loan amounts for expansion by acquiring an existing business, as well as machinery/equipment purchases.

Average loan amount for different business purposes

| Loan purpose | Average loan amount |

|---|---|

$261,944 | |

$181,434 | |

$85,608 | |

$75,552 | |

$58,706 | |

$55,250 | |

Other | $112,047 |

Business credit card statistics

Business credit card spending has surged since the end of the COVID-19 pandemic.

In fact, the monthly transaction value hit another all-time high in June 2024, at $8.64 billion.

There are around 842,800 commercial credit cards accounts in Australia, meaning the average account has a monthly balance of $15,166.

You can read more on credit card usage in Australia in your credit card debt guide.