Compare Business Overdrafts & Rates

Get your best business overdraft rates from top Australian lenders.

Fast, hassle-free overdraft options up to $1m

Compare rates starting from 14.35%

Get help from our experts at every step

Our business finance experts are here to help. Updated 15 Dec 2025.

How to get your best business overdraft rate

In just three simple steps...

Step 1

Tell us about your business

That way we can narrow down your options to suitable lenders.

Step 2

Compare overdraft options

We’ll present your best overdraft rates, fees and limits from a range of providers.

Step 3

Get help with your application

We’ll do the leg work to give you the best chance of fast approval.

What is a business overdraft?

A business overdraft gives a business ongoing access to finance up to a limit. The business can dip into its overdraft whenever it needs funds, and only pay interest on the amount drawn down until they are repaid.

An overdraft typically allows a business to transfer funds to its business transaction account as needed. The transfer of funds is instant, making it a popular source of cashflow for ongoing expenses. It's similar to a business line of credit.

A business overdraft is a popular form of business finance used in almost every industry, for managing working capital, purchasing inventory, and much more.

What you get with a business overdraft

- Access credit limits from $2,000 to $2 million

- Interest rates generally range between 14.35% p.a. - 25.00% p.a.

- Interest only charged on amount withdrawn

- Overdraft fees may be charged on application and/or annually

- Business overdrafts can be secured or unsecured

- Applications assessed according to business turnover

- Usually quicker than applying for a loan

- Offered by banks and non-bank lenders

How a business overdraft works

Some people might still think of a business overdraft as a facility linked to a transaction account offered by a bank. But today, business overdrafts are offered by a range of non-bank lenders offering instant and ongoing access to funds.

Money.com.au's Business Finance Expert, Phil Collard. explains:

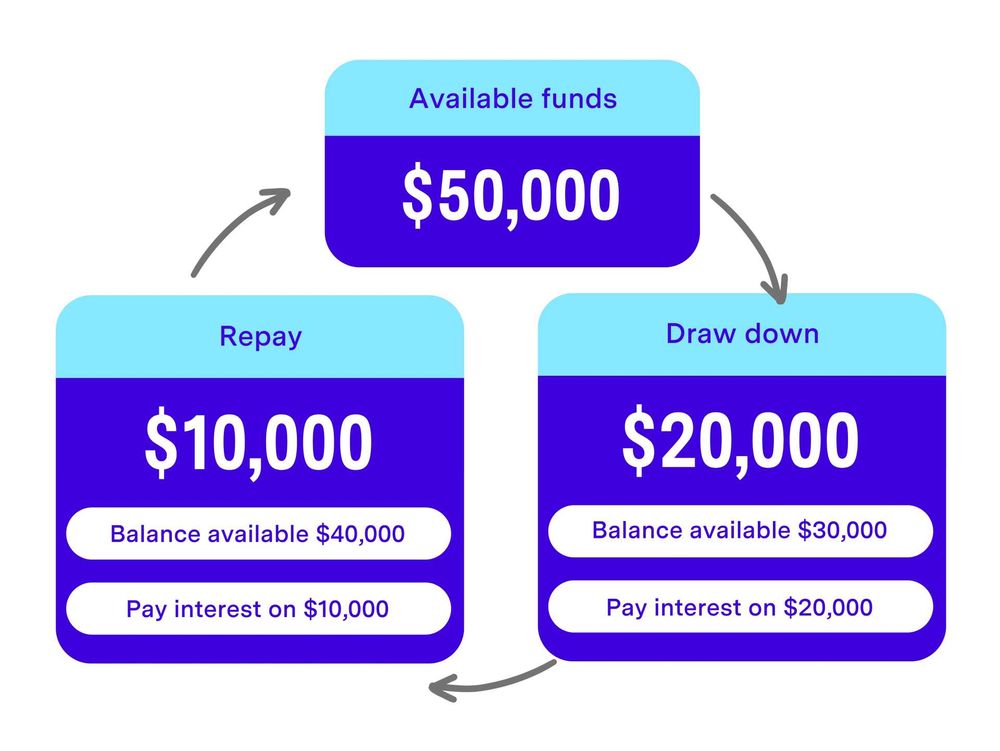

“Let's use a $50,000 overdraft facility as an example. Rather than getting a loan where you've got all the funds dispersed to your bank account up front and then weekly payments for two years or whatever, the overdraft effectively sits off balance sheet.

"It sits in a lender's portal and as a business owner you can simply log in and draw down from that $50,000 limit by however much you need at a given time. You could draw down $20,000 today to pay for stock, inventory, whatever it is you may need, and that gets dispersed to your business bank account instantly.”

Business overdraft interest rates

Business overdraft interest rates in 2025 can range from around 14.35% to 25.00% p.a. according to data from Money’s lender database shows. Some banks advertise lower rates than these, but these rates tend to only be available for established businesses with a near-perfect credit history.

To give you an idea of the current rates on unsecured business loans, we have rounded up the offers from a selection of prominent lenders.

Lender | ANZ |

|---|---|

Business overdraft rates from | 15.95% p.a. |

Overdraft limits | $2,000 - $300,000 |

Lender | Beyond Bank |

Business overdraft rates from | 12.99% p.a. |

Overdraft limits | From $10,000 |

Lender | Dynamoney |

Business overdraft rates from | 14.35% p.a. |

Overdraft limits | $5,000 - $250,000 |

Lender | Great Southern Bank |

Business overdraft rates from | 14.45% p.a. |

Overdraft limits | Up to $50,000 |

Lender | NAB |

Business overdraft rates from | 15.75% p.a. |

Overdraft limits | $5,000 - $50,000 |

Lender | Shift |

Business overdraft rates from | 14.95% p.a. |

Overdraft limits | $25,000 - $1 million |

Lender | Suncorp |

Business overdraft rates from | 15.24% p.a. |

Overdraft limits | Up to $50,000 |

Lender | Westpac |

Business overdraft rates from | 12.96% p.a. |

Overdraft limits | Up to $250,000 |

| Lender | Business overdraft rates from | Overdraft limits |

|---|---|---|

ANZ | 15.95% p.a. | $2,000 - $300,000 |

Beyond Bank | 12.99% p.a. | From $10,000 |

Dynamoney | 14.35% p.a. | $5,000 - $250,000 |

Great Southern Bank | 14.45% p.a. | Up to $50,000 |

NAB | 15.75% p.a. | $5,000 - $50,000 |

Shift | 14.95% p.a. | $25,000 - $1 million |

Suncorp | 15.24% p.a. | Up to $50,000 |

Westpac | 12.96% p.a. | Up to $250,000 |

Why businesses use an overdraft

Seasonal cashflow

For industries that experience seasonality or cyclical business, unsecured finance helps smooth out those bumpy roads in cash flow throughout the course of a trading year.

Always-on credit

A business overdraft can become an embedded part of your business’ day-to-day cashflow, always available to cover costs and ensure operational continuity.

Rainy day buffer

While there is a cost to maintaining a business overdraft, the benefit of having funds available to draw on instantly, whatever happens, is worth it for many businesses.

Simple and cost effective

With a business overdraft you make one application and then have ongoing access to funds which you can draw on repeatedly. You only pay interest on funds you use.

Using an overdraft for ongoing growth

Phil Collard, Money.com.au Business Finance Broker

"Let’s say we have a business owner planning on going on a six-month growth journey, with marketing, new staff and expanding to another location. An overdraft could be a great option, because you've got the flexibility to take out what you need when you need it. You could set up a $150,000 overdraft today, but only draw down some of the funds up-front, then another tranche in a month's time, and so forth. There's no point in that customer paying interest on that whole $150K when they don't need all of it upfront. With an overdraft, there’s also no need to reapply for finance when the next injection of capital is required."

Phil Collard, Money.com.au Business Finance Broker

Business overdraft versus term loan: Which will be best?

Compared to an unsecured business loan, a business overdraft offers more flexibility and longevity. The finance available is constantly refreshing. Instead of needing to reapply for funds every time, you can dip in and out. By contrast, term loans are often there to fix a one-off problem, or capitalise on a one-off opportunity.

If your business has a high turnover and needs fast access to funds on an irregular basis, an overdraft may be suitable as it offers quick and reliable access to funds. That could be for paying invoices, paying staff, doing fit outs or just having some extra working capital.

In our experience working with Australian businesses, industries commonly using a business overdraft include retail, wholesale, manufacturing, professional services, food and beverage, technology and automotive.

A business overdraft is generally not as well suited to long-term capital investment, like purchasing an asset. In that scenario, equipment finance, a business car loan or chattel mortgage may be a better fit.

Interest rates on business overdrafts vs business loans

Business overdraft interest rates are typically higher than those available on unsecured business term loans. Business overdraft rates start from 14.35% p.a., compared with 11.75% for an unsecured loan, according to Money.com.au’s database of lenders (as at September 2025). Across the market, Reserve Bank of Australia data also indicates a 2.03% gap between overdrafts and term loans for businesses, with the gap currently larger than it has ever been. However, for short-term finance, using an overdraft can still work out cheaper, with greater flexibility built in.

7 steps to getting a low-cost business overdraft

1. Compare options beyond your existing bank

If you decide to get a business overdraft set up, applying with the bank you already have a transaction account with might seem like the most obvious first step. But you should compare your options first.

Like any kind of business finance, the interest rates, fees and other terms on business overdrafts can vary a lot depending which provider you go with.

2. Look for the lowest fees possible

With a business overdraft, expect to pay an application fee as well as a line fee, which will likely be quarterly or annually. The lender charges a line fee for keeping the overdraft facility open and it applies whether you use the overdraft or not. Line fees are either a flat amount or can be a percentage of the credit limit.

There can also be hefty fees if you draw down funds beyond your overdraft limit.

In our experience, not all lenders advertise the actual fees they charge. Instead, fees are "determined upon application" or something similarly vague. This is where we come in. We'll help you understand the business overdraft fees charged by multiple lenders, without you needing to apply first.

3. Shop for the lowest interest rate you qualify for

There’s a massive difference between the highest and lowest business overdraft rates. Particularly if you will have funds overdrawn on a regular basis, it’s important to look for the lowest interest rate possible (even though you’ll only be charged interest on funds withdrawn).

Your interest rate will be tailored to your business depending on factors like annual turnover and how long it’s been operating. Your personal credit rating may also be a factor.

4. Consider whether a secured or unsecured overdraft is best

You generally have the choice of a secured or unsecured business overdraft. A secured overdraft will be backed by an asset you or your business owns (usually residential or commercial property).

Interest rates and fees are usually lower on secured overdrafts. But if you need a quick approval, an unsecured overdraft is usually more straightforward to apply for.

5. Pick a suitable overdraft term

Terms on a business overdraft range from 3 months to 5 years, or some involve a ‘revolving’ line of credit with no set term. Even if you agree to a set term with a lender, they may be able to review the overdraft facility at any time.

Importantly, if you only need help with cash flow for a short period of time or one-off project, avoid signing up for an overdraft with a long or open-ended term. You'll likely be charged overdraft fees long after the overdraft has served its purpose.

6. Pay attention to the repayment requirements

A traditional bank overdraft typically won't have set repayment requirements. You essentially repay it as and when funds are deposited into your account. This is obviously a very flexible option. It can also be very expensive as interest charges are added until the overdraft is cleared in full.

Most of the specialist lenders we work with set a minimum principal repayment amount on business overdraft facilities. This means there will be a limit on how much interest you will pay over time on the amount overdrawn.

7. Choose your overdraft limit carefully

There are two ways you could arrive at a suitable overdraft limit for your business:

- What the lender is willing to offer you as a maximum credit facility; and

- The amount you actually need.

Some fees are charged as a percentage of your limit. In other cases, there are fee bands. A higher overdraft limit could move you into a higher fee band. Either way, a higher overdraft limit than your business needs will cost you more.

Did you know? Business overdraft fees and interest may be tax deductible if the funds borrowed are used for business purposes, according to the ATO.

Business owner case study

Catherine Cervasio, Founder of Australian natural skincare brand Aromababy

“We took out an overdraft to fund inventory which meant we have stock available in order to take advantage of growth opportunities - especially critical for export where we wouldn't carry adequate stock levels otherwise. We decided on an overdraft (low doc, easy application) vs a loan due to ease and interest rates.”

Catherine Cervasio, Founder of Australian natural skincare brand Aromababy

Am I eligible for a business overdraft?

To qualify for a business overdraft, you’ll need to pass the lender’s credit assessment criteria:

- You are a sole trader, partnership, trust or company with a valid ABN

- You are an Australian citizen or permanent resident with a residential address in Australia

- Your business is registered for GST and has been operating for at least 6-12 months (minimum trading requirements vary by lender)

- Your business revenue is above the lender’s minimum limit

- You have a good credit history

- You intend to use the overdraft for business purposes

How to apply for a business overdraft

You can apply for a business overdraft online with most lenders. Many borrowers prefer non-bank and specialist lenders due to the fast approval time and access to funds offered by these companies.

The difference can be as significant as approval within 24 hours with a specialist lender, versus four to six weeks with a major bank.

If you are looking for a business overdraft limit below $150,000, some lenders will only require business bank statements, plus a personal guarantee from a director, to grant approval. You could apply online and have the funds available the next day.

Secured versus unsecured business overdraft

Secured business overdraft

With a secured overdraft, an asset owned by you or your business serves as collateral for the finance. If you default on the overdraft repayments, the lender can recoup its money by making a claim on the asset. Interest rates on a secured overdraft are typically lower as there is less risk for the lender.

Unsecured business overdraft

With an unsecured overdraft, there is no specific asset serving as collateral. But it’s important to remember that even unsecured finance contracts often include clauses allowing the lender to make a claim on assets in your name in the event of a default. Interest rates on an unsecured overdraft are typically higher.

An unsecured overdraft is not dissimilar to a business credit card or charge card, but with a larger limit and potentially lower fees. For example, some overdraft facilities don't have monthly account keeping fees and there's generally no early payment fees.

What fees are there on a business overdraft?

A business overdraft typically comes with up-front and ongoing fees, including:

- Establishment or setup fee A one-off fee charged when the overdraft facility is first approved. This covers the lender’s cost for assessing and setting up the credit limit.

- Line or facility fee An ongoing fee (monthly, quarterly, or annually) charged for having the overdraft available, regardless of whether you use it. It’s usually a percentage of the approved limit (e.g. 1%–2%).

- Drawdown fees There may be a fee each time you make a withdrawal from your overdraft facility. This may be a fixed amount or a percentage of the withdrawal.

- Over-limit fee If you exceed your approved overdraft limit, you may be charged an over-limit or unauthorised overdraft fee, and a higher interest rate may apply to the excess amount.

- Account-keeping or service fees Some lenders charge a regular account maintenance fee in addition to the facility fee, to cover administration costs.

- Renewal, review or cancellation fees Lenders may charge a fee to review or renew the facility at the end of the current term (if there is a fixed term), or indeed to cancel the overdraft.

Some of our happy business finance customers

FAQs about business overdrafts

Is a business overdraft better than a loan?

This depends on what the business needs the finance for. An overdraft is generally more suitable for plugging cash flow gaps to cover ad-hoc or recurring expenses, with the funds generally repaid over a shorter time-frame (up to two years). A term loan, on the other hand, may work better for large one-off expenses that need to be repaid over a longer period (up to seven years).

Is there a limit on the number of withdrawals?

Usually not. Once you are approved for your business overdraft, you will be free to access the funds as and when they are required.

You'll still need to pay an annual facility fee for access to your overdraft, and remember that any amount used will incur interest charges until it is repaid.

Can I get an unsecured business overdraft?

Yes, you can apply without providing a deposit or any collateral as security directly linked to your overdraft. This is referred to as an unsecured business overdraft and a popular way to access funds quickly for a business. But much like unsecured business loans, the interest rate on an overdraft will likely be higher without security as there is more risk for the lender.

What’s the average business overdraft interest rate?

Interest rates on a business overdraft in Australia can vary widely, between around 14.35% and 25%. The average interest rate for a secured overdraft will typically be at the lower end of the range, with unsecured overdrafts often attracting higher rates.

Can I increase my overdraft limit?

Yes. Provided you can demonstrate an ability to meet repayments on the new amount through increased business turnover, your lender should allow you to increase your overdraft limit.

What is an unapproved business overdraft?

An unapproved business overdraft is a situation where a business withdraws funds beyond what’s available in their transaction account, but there is no official overdraft agreement between you and your bank.

If this happens, depending on the bank, the funds may still be made available, but there will be significant costs for the business in the form of fees, plus interest charged on the funds overdrawn.

Interest charged on an unapproved overdraft can be significantly higher than those on an overdraft that you have arranged with a lender.