What does salary sacrificing a car mean?

Salary sacrificing a car means using part of your pre-tax income to pay for an eligible personal vehicle through your employer. The salary deduction covers the vehicle plus most running expenses.

This arrangement – often called a novated lease or salary packaging – reduces your taxable income, which can lower the amount of income tax you pay.

In Australia, you can also salary sacrifice other expenses, such as:

- Superannuation contributions

- Mortgage repayments

- School fees and child care

Not all employers offer the same salary sacrifice options, and the tax implications can vary depending on what you’re packaging. That said, salary sacrificing a car remains one of the most popular and accessible ways for employees to finance a vehicle.

How does salary sacrificing a car work?

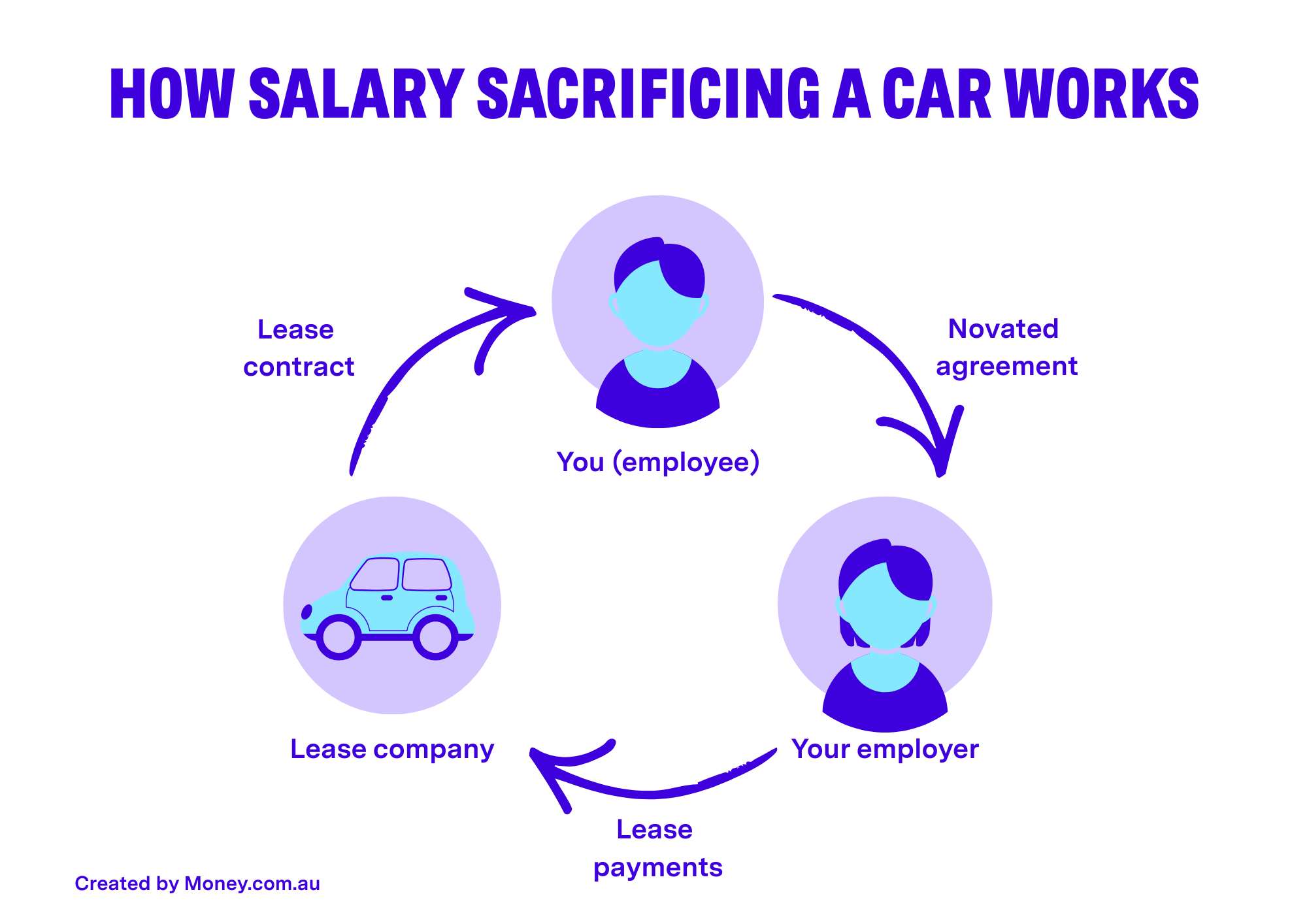

With a salary sacrifice car arrangement, you pay for your vehicle and running costs through your employer using pre-tax salary. This is done through a novated lease, which is an agreement between you, your employer and a novated lease company.

Here’s how it works:

You (the employee)

You choose a new or used car to salary sacrifice through a novated lease provider. You’ll benefit from a GST discount on the purchase price, and you can use the car for unlimited personal use.

The novated lease provider

The provider can help you source the vehicle but you can also shop around and find one yourself. They’ll manage all the running expenses and then invoice your employer for the lease payments and operating costs. If you’re leasing a petrol or diesel car, they’ll also issue a fuel card.

Your employer

Your employer deducts the required amount from your pre-tax salary to cover the lease payments and ongoing costs – with GST discounts applying here as well. Then your employer pays the novated lease provider on your behalf.

You can salary sacrifice pretty much any passenger car (new or used) for a duration between one and five years. You also have control over which car running costs to include, with the flexibility to change your budget down the track if your driving habits change.

What happens at the end of a salary sacrifice car agreement?

When your salary sacrifice term ends (usually after 1-5 years), you’ll have three options:

- 1. Buy the car outright: Make the residual payment – a lump sum based on a set percentage of the car’s original purchase price – and the vehicle becomes yours.

- 2. Upgrade to a new car: Trade in your current vehicle and use its sale value to pay off the residual. If the trade-in value is higher than the residual, you keep the difference tax-free. This is a common option, as it allows you to roll straight into a new car and lease.

- 3. Extend your lease: Continue leasing the same car and refinance the residual into a new lease term. Your repayments will likely be lower, as the original lease has already covered most of the car’s cost.

Salary sacrifice car pros

GST saving on vehicle purchase price

When you salary sacrifice a car, you don’t pay GST on the purchase price because your employer claims the GST credit. Right now, this GST saving is capped at $6,334. This effectively reduces the upfront cost of the car before your lease even begins.

Save $1,000s in income tax

Because your lease payments and running costs are taken from your pre-tax salary, your taxable income is reduced. This can lead to savings of thousands of dollars over the life of the lease.

More GST savings on car ongoing costs

You also avoid paying GST on running expenses like servicing, tyres, fuel, insurance and registration. These costs are bundled into your pre-tax payments, giving you additional year-round savings.

No fringe benefits tax (FBT) on eligible EVs

Eligible electric vehicles are exempt from FBT under current Australian rules, making them significantly cheaper to salary sacrifice. This exemption can make salary sacrificing an EV one of the most cost-effective options. The Australian Government is due to review this incentive in mid-2027.

Tax expert Ed Beasley from chartered accountants Smith Feutrill told Money.com.au that the key tax advantage for employees is being able to pay vehicle costs using pre-tax income.

“The added benefit is that GST on the car is claimed by the employer, and this saving is passed onto the employee,” he said.

Salary sacrificing a car is a popular way to pay for a vehicle, with some major tax advantages you can’t get with a car loan or paying with cash. But the benefits do vary from person to person.

While we’ve outlined a few of the main benefits above, there are some disadvantages of novated leasing worth weighing up before you decide if it’s right for you. In any case, always seek advice from a qualified tax professional to understand how salary packaging a car may affect your personal situation.

Cons of salary sacrificing a car

Fringe benefits tax (FBT) can eat into your savings

Most employee benefits, including salary sacrificing, attract FBT. Most providers structure novated leases to minimise or eliminate FBT, but this means that only part of the lease payments are made using pre-tax salary. Eligible EVs under the luxury car tax (LCT) threshold are fully exempt from FBT.

You’ll face a residual (balloon) payment

When the salary sacrifice agreement ends, in order to own the car you’ll need to pay off the residual value of the car. Unlike all of your salary sacrifice payments up until this point, the last large payment (sometimes called the balloon payment) must be made with after-tax money and it includes GST.

It can get tricky if you change jobs

If you switch employers mid-lease, the agreement needs to be transferred – and your new employer must be willing to take it on. If they don’t, you may need to take over the lease privately or pay it out, which requires some extra planning.

It’s not suitable for everyone

Salary sacrificing is only available if your employer offers it and only applies to eligible passenger vehicles. It also works best for people earning enough to benefit from tax savings; as tax expert Ed Beasley notes, those close to the tax-free threshold ($18,200) may see little to no benefit.

How does salary sacrificing a car compare to a car loan or buying outright?

We crunched the numbers on the potential cost saving by paying for a car through salary packaging over a 5-year term, versus paying with a car loan or using cash.

This example is based on a BYD SEALION 7 Premium with a driveaway price of $54,900. The calculation assumes a buyer from NSW with a yearly pre-tax income of $100,000, driving 15,000km annually.

Estimated vehicle running costs include comprehensive car insurance, servicing, registration and tyres. Example assumes a finance interest rate of 7.00% p.a.

Money.com.au’s analysis shows salary sacrificing this vehicle would mean a total tax saving of $37,042 over five years.

Novated lease vs cash vs car loan calculation

Driveaway price (BYD SEALION 7 Premium) | |

Novated lease | $54,900 |

Cash | $54,900 |

Car loan | $54,900 |

GST saving on purchase price | |

Novated lease | $4,991 |

Cash | n/a |

Car loan | n/a |

Monthly cost (finance and/or running costs) | |

Novated lease | $864 |

Cash | Running costs $325 |

Car loan | Loan: $1,087 Running costs: $325 Total: $1,412 |

Cost over 5 years | |

Novated lease | $51,940 |

Cash | $74,408 |

Car loan | $84,720 |

Residual payment | |

Novated lease | $15,433 |

Cash | n/a |

Car loan | n/a |

Total cost to own car and run for 5 years | |

Novated lease | $67,373 |

Cash | $74,408 |

Car loan | $84,720 |

Cost difference | |

Novated lease | |

Cash | $7,035 |

Car loan | $17,347 |

Total tax saving over 5 years | |

Novated lease | $37,042 |

Cash | n/a |

Car loan | n/a |

| Novated lease | Cash | Car loan | |

|---|---|---|---|

Driveaway price (BYD SEALION 7 Premium) | $54,900 | $54,900 | $54,900 |

GST saving on purchase price | $4,991 | n/a | n/a |

Monthly cost (finance and/or running costs) | $864 | Running costs $325 | Loan: $1,087 Running costs: $325 Total: $1,412 |

Cost over 5 years | $51,940 | $74,408 | $84,720 |

Residual payment | $15,433 | n/a | n/a |

Total cost to own car and run for 5 years | $67,373 | $74,408 | $84,720 |

Cost difference | $7,035 | $17,347 | |

Total tax saving over 5 years | $37,042 | n/a | n/a |

While the table above shows bigger savings for a novated lease on an electric car (BYD SEALION 7 Premium), the numbers will look different for a petrol vehicle. This example isn’t a one-size-fits-all view of potential savings, as the final outcome depends on your personal circumstances and the car you choose.

My experience with car salary sacrificing

Money.com.au’s Senior Finance Writer, Jared Mullane, shares his experiences with salary packaging family cars.

How two salary-sacrificed family cars taught me what works – and what doesn’t.

Being able to bundle more or less all of your car costs into one payment as part of a novated lease deal (which is automatically deducted from your salary) is very convenient for a lot of drivers. It means no more budgeting for the sometimes unpredictable costs of keeping a car on the road.

How to salary sacrifice a car in Australia

Check whether your employer offers the benefit

Not all employers provide salary sacrifice car options, so start by asking HR or payroll. Confirm that they allow novated leasing, and check if there are any internal policies or approval steps. Make sure you understand how the deductions will be taken from your pay.

Work out if it suits you

Before moving ahead, consider whether it’s the right fit. Do you have enough pre-tax income to cover the deductions? Are you likely to stay with your employer for the length of the lease? Think about how many kilometres you drive each year, as higher usage can affect costs.

Find a reputable novated lease provider

Compare a few providers to see who offers good pricing and useful inclusions, such as fuel cards, servicing and tyres. Read reviews and request an example cost breakdown based on your preferred car and estimated annual kilometres.

Choose your car and the lease structure

Decide on the car you want, whether new or used, and choose your lease term, usually one to five years. Check the residual value at the end of the lease and decide which running costs you want to include in the budget.

Get a formal quote and run the numbers

Ask for a detailed quote that outlines your pre-tax deductions, the interest rate, running cost estimates and the final residual amount. Review how this affects your take-home pay and make sure it fits your budget and lifestyle.

Submit an application and sign the novation agreement

Complete the application with your chosen provider. You, your employer and the lease company will all sign the novation agreement. Once the paperwork is finalised, payroll will start the deductions on your behalf.

Order the vehicle

After approval, the lease provider or you can place the order for the car. Confirm delivery timeframes and clarify who will arrange registration and insurance.

Drive away and start the lease

When you collect the car, your salary sacrifice deductions will begin. The lease provider usually manages invoices and pays approved running costs from your budget. You can track spending through their app or online portal, and claim any out-of-pocket expenses if needed.

Documents you’ll need to provide

Much like applying for a car loan, you will need to provide the following documents to the lease provider:

- Recent payslips and proof of employment

- Driver’s licence and other valid ID

- Details of the car you want (make/model or dealer quote)

- A clear idea of annual kilometres (i.e. 10,000/15,000kms)

- Bank details for any post-tax contributions

How does car salary sacrificing work for employers?

Payroll deductions

Your company agrees to make automated payroll deductions from the employee’s pre-tax salary. These funds are then paid directly to the novated lease provider to cover the lease and any bundled running costs.

Admin and contract management

Most of the ongoing administration sits with the novated leasing company. They set up the lease, manage the contract, handle compliance, organise invoices for running costs and provide reporting when needed.

Vehicle ownership during the lease

Throughout the salary sacrifice period, the vehicle is technically owned by the lease provider. This makes no practical difference to the employee’s day-to-day use of the car – they drive it as if it were their own.

Flexibility if the employee leaves

The lease isn’t tied to you as the employer. If the employee resigns, the lease transfers with them to their new employer, or they can choose to take over payments directly.