NOVATED LEASE

Guide to novated lease residual values

Sean Callery

A novated lease means you can pay for a new or used car plus running costs through your salary to save on tax. Read our guide to understand how exactly it works.

Expert novated lease guide written by Sean Callery and fact checked by Jared Mullane. Updated 17 Dec 2025.

Sponsored

A novated lease is a way of financing a new or used vehicle and paying for car running costs through your pre-tax salary. It means you pay less income tax and can save on GST on the upfront cost of the vehicle and ongoing costs.

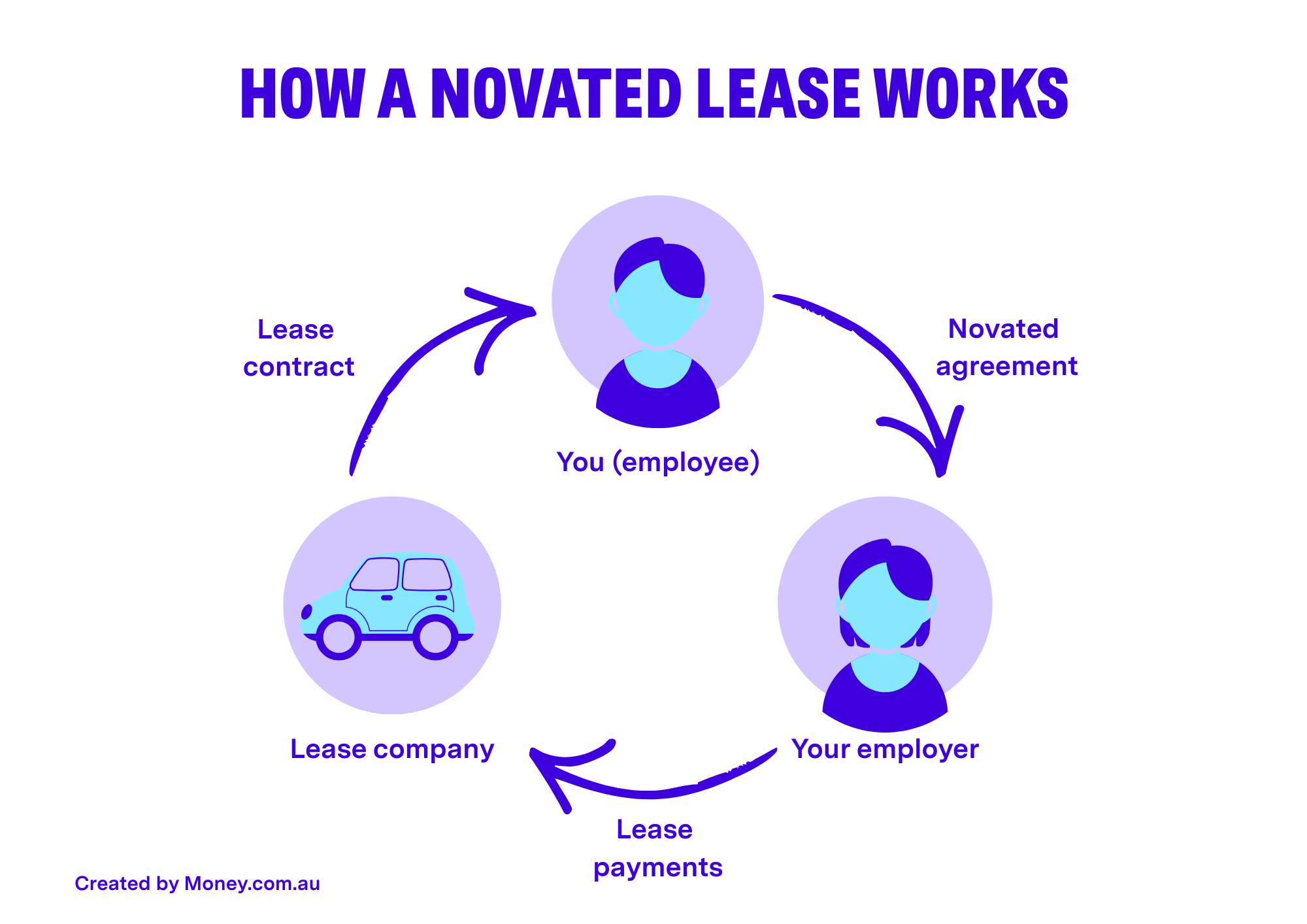

A novated lease involves your employer, but the vehicle can be used 100% for personal use. Because the payments come directly from your salary, novated leasing is sometimes referred to as salary packaging or salary sacrificing a car.

Let’s look step-by-step at how a novated lease works in Australia:

You select the new or used vehicle you want, either by yourself or with help from your novated lease provider. They can guide you to suitable options that meet your budget and lease requirements.

The novated lease company purchases the car on your behalf, often with a GST discount, and then leases it to you under a formal agreement.

Your employer deducts the lease payments from your pre-tax salary and sends them directly to the leasing company. This setup can reduce your taxable income and make payments more manageable.

You can choose to bundle running costs – such as fuel, servicing, insurance and registration – into the lease. These costs may also benefit from GST savings and are typically calculated based on your expected annual kilometres.

At the end of the lease term, you can pay the residual value to own the car outright or start a new lease on a different vehicle. Some providers also offer flexible options if you want to upgrade or extend the lease.

A novated lease is essentially a three-way partnership between you, your employer and the lease provider. The lease provider arranges the finance through a lender that provides the funds to purchase the vehicle.

The lease provider can help secure the vehicle on your behalf, or you’re free to find your own vehicle. Your employer then makes regular deductions from your pre-tax salary to cover the lease payments.

Novated lease payments are made at least partly from your pre-tax salary, which reduces your taxable income. This means you effectively pay less tax while using your car.

You can claim GST savings on the purchase price of your vehicle as well as on eligible running costs, such as servicing, fuel and insurance, which can make a significant difference over the life of the lease.

If you choose an eligible electric vehicle, a novated lease can offer extra tax benefits. That’s because eligible EVs are exempt from fringe benefits tax (FBT), meaning the full cost of the car and running expenses may be salary sacrificed using pre-tax salary (otherwise lease payments are made using a combination of pre-and post-tax salary).

Lease companies often have access to fleet discounts through their network of dealerships. These savings are passed on to you, often giving you a better novated lease deal on the vehicle.

Many novated leases allow you to include scheduled servicing and repairs in your lease package. This can make maintenance easier to manage and reduce unexpected costs, like a blown tyre.

Some leases include a fuel or electric charging card, helping you pay for running costs easily while potentially saving GST on these expenses.

With most running costs bundled into a single lease payment, it’s easier to plan your monthly budget without worrying about separate bills.

Most providers give you access to an online portal or an app where you can track your lease, manage payments and view upcoming costs, making it simple to stay on top of your car expenses.

The example below demonstrates the potential savings on one of Australia’s most popular electric vehicles (EVs).

Driveaway price (BYD SEALION 7 Premium) | |

Novated lease | $54,900 |

Cash | $54,900 |

Car loan | $54,900 |

GST saving on purchase price | |

Novated lease | $4,991 |

Cash | n/a |

Car loan | n/a |

Monthly cost (finance and/or running costs) | |

Novated lease | $864 |

Cash | Running costs $325 |

Car loan | Loan: $1,087 Running costs: $325 Total: $1,412 |

Cost over 5 years | |

Novated lease | $51,940 |

Cash | $74,408 |

Car loan | $84,720 |

Residual payment | |

Novated lease | $15,433 |

Cash | n/a |

Car loan | n/a |

Total cost to own car and run for 5 years | |

Novated lease | $67,373 |

Cash | $74,408 |

Car loan | $84,720 |

Cost difference | |

Novated lease | |

Cash | $7,035 |

Car loan | $17,347 |

Total tax saving over 5 years | |

Novated lease | $37,042 |

Cash | n/a |

Car loan | n/a |

| Novated lease | Cash | Car loan | |

|---|---|---|---|

Driveaway price (BYD SEALION 7 Premium) | $54,900 | $54,900 | $54,900 |

GST saving on purchase price | $4,991 | n/a | n/a |

Monthly cost (finance and/or running costs) | $864 | Running costs $325 | Loan: $1,087 Running costs: $325 Total: $1,412 |

Cost over 5 years | $51,940 | $74,408 | $84,720 |

Residual payment | $15,433 | n/a | n/a |

Total cost to own car and run for 5 years | $67,373 | $74,408 | $84,720 |

Cost difference | $7,035 | $17,347 | |

Total tax saving over 5 years | $37,042 | n/a | n/a |

A fully maintained novated lease lets you package the running costs of the vehicle into your pre-tax payment, which saves you even more money. This is by far the most popular choice. Not least because you will also pay no GST on the packaged running costs for your vehicle.

The fully maintained option typically includes:

These costs will be estimated based on the number of kilometres you intend to drive each year but can be changed later on.

Depending on the agreement, you may have the option to choose the supplier for these (e.g. your insurer of choice). Or you might be limited to the leasing company’s preferred supplier (e.g. a fuel card that can only be used at certain petrol stations).

With a non-maintained novated lease, your payments only cover the vehicle repayments and the finance costs, including interest and fees. You’ll need to cover the running costs of the vehicle yourself.

A self-managed novated lease lets you arrange the finance with a lender yourself. A novated leasing company may then assist with setting up the salary sacrifice with your employer or you might have to do this yourself.

Interest rates on a novated lease generally range from 7% p.a. to 12% p.a., but can be higher depending on your situation. Novated lease interest rates are set by the lease provider’s financier (i.e. the lender they’re partnered with) and are more or less influenced by the same factors as car loan interest rates.

Other factors that impact the interest rate on a novated lease include:

You can generally qualify for a novated lease if you are:

You can also use a novated lease to finance a new or used car. It just needs to be a passenger vehicle (including utes), with a maximum payload of one tonne. If it’s a novated lease for a used car, the vehicle generally needs to be less than 15 years old at the end of the lease term.

You can typically also use a novated lease whether you buy through a car dealership or private seller. Just bear in mind there generally is no GST saving with a private sale.

Leasing a car can be a cost-effective option if your employer allows salary packaging and you want to simplify how you budget for car costs. Many drivers like the convenience: your repayments, running expenses and servicing can all be packaged into one automatic salary deduction (with a tax saving), which removes a lot of admin and unexpected bills.

Along with the potential tax benefits, the numbers generally stack up favourably versus a traditional car loan. Using a novated lease calculator can help you see whether the savings apply to your situation.

If you’re a low income earner, you may not benefit as much from the tax savings, and the take-home pay reduction might feel too tight. You’ll also need an employer who supports salary sacrificing, and you should feel comfortable committing to regular deductions for the full lease term.

Overall, it’s worth weighing up the pros and cons of novated leasing and speaking with a financial or tax professional to confirm whether this type of car finance suits your circumstances.

A novated lease and a car loan are both ways of financing a vehicle, with no restrictions on whether the vehicle is used for personal or business purposes. The main difference between a novated lease and a car loan is in how the vehicle is financed and taxed:

You have three options available at the end of your novated lease:

The balloon or ‘residual’ amount is a pre-determined lump-sum repayment made at the end of the novated lease term. The residual amount will vary, and shorter terms will have higher residuals attached.

If you are using the car to travel extensively (35,000 km or more per year) you can usually opt for a lower residual.

Speak to your leasing provider about this.

It’s important to bear in mind that novated leases are subject to fringe benefits tax (FBT). This is a tax that applies to most non-salary employee benefits. It’s payable by the employer, not the employee, but novated leases are generally set up so that there is no FBT payable at all.

To do this, the lease provider generally sets up the salary deductions to be partly made up of post-tax repayments. This is known as the employee contribution method (ECM). It reduces the tax benefit for the employer, but means the employer does not need to pay additional tax in order to offer the benefit.

The current exception to this situation is low or zero-emission vehicles – electric cars (EVs) – which are exempt from FBT up to the luxury car tax threshold.

This means eligible electric car novated leases are eligible for significant further savings as 100% of the salary deduction can be made using pre-tax salary.

The short answer is no. There used to be a requirement, but that was over 10 years ago. It doesn't matter whether you drive 10,000 km or 30,000 km or whether you drive for personal or business use.

No, if you are self-employed – i.e. are not paid a salary by an employer or receiving a salary through your own company – you will need to look at alternative forms of vehicle finance, such as a chattel mortgage for business vehicles, or low-doc car loan.

Novated leasing allows for a maximum vehicle payload of 1,000 kg (one tonne) – if you want to finance heavy machinery, a non-passenger vehicle, or vehicles with a heavier payload than the maximum limit, you may wish to consider a chattel mortgage or equipment finance as alternatives.

Even employees on a modest salary (e.g. $65,000 a year) may be able to take advantage of novated lease benefits. Eligibility comes down to the cost of the vehicle and your capacity as a borrower, which will be impacted by your credit history, plus your other financial obligations and expenses.

If you leave your job during the term of your novated lease, you will still be responsible for finance payments on the vehicle. The lease will be “de-novated”, the running costs are removed from the agreement and repayments will continue much the same way as a standard car loan.

When you are employed again – provided your new employer agrees to salary packaging the vehicle – the lease can be re-novated, and revert back to its initial state including running costs.

If your new employer accepts novated leasing, then you will simply be able to transfer your lease to them. There is a bit of paperwork involved, but largely it’s a seamless process.