What is a 40-year mortgage?

A 40-year mortgage is a home loan with an extended loan term of four decades. Instead of repaying the loan over the standard 30 years, borrowers spread repayments over 40 years.

This significantly lowers the required monthly repayment, which may help some borrowers pass the assessment process. However, the trade off is that borrowers pay far more interest over the full term of the loan.

What are the pros and cons of a 40-year mortgage?

Like any financial product, a 40-year home loan comes with benefits and trade-offs. Because the loan runs for a longer time, it’s important to consider both the pros and cons before committing.

Upsides:

- Lower monthly repayments: Spreading a mortgage across 40 years reduces the repayment amount, making your monthly budget more manageable.

- Greater borrowing capacity: Lower repayments may mean increased borrowing power, allowing some borrowers to access properties that would otherwise be out of reach.

- Could help first home buyers enter the market sooner: With housing affordability at record lows, extending the loan term may offer a pathway for first home buyers who are struggling to keep up with rising prices.

- Flexibility: If they can afford to, borrowers will generally have the ability to pay extra every month to reduce their loan term faster. Then if they need to, they can revert to making the lower minimum repayment.

Downsides:

- Much more interest paid over the life of the loan: The biggest drawback. Extending a mortgage by an extra 10 years dramatically increases total interest costs, even if interest rates stay around the same

- Remaining in debt later in life: Many borrowers will still be making repayments in their 60s and 70s, which could have negative consequences for retirement planning and financial security in later life

- Greater long term financial risk: Longer loans expose borrowers to more uncertainty. Future rate rises, loss of income or changes in personal circumstances pose more of a risk over a 40-year period.

- Fewer lenders to choose from: Fewer lenders offering 40-year mortgages means far less choices for borrowers looking for a long-term home loan. With limited providers, interest rates and fees could be less competitive, meaning borrowers could pay more over the term of the loan simply because there aren’t many alternatives on offer.

While the lower repayments may be tempting, it’s crucial to understand the long-term financial impact to determine whether the benefits outweigh the risks.

Why are 40-year mortgages being offered now?

According to Debbie Hays, Senior Mortgage Broker at Money.com.au, there are several factors driving the rise in 40 year mortgages in Australia.

These include:

- Housing affordability: Property prices in many parts of Australia have risen faster than household incomes, making it increasingly difficult for buyers to qualify for a standard 30-year loan. Extending the mortgage term to 40 years reduces the required monthly repayment, which can help some borrowers meet lender’s assessment criteria and access homes that would otherwise be unaffordable.

- Cost of living: Higher interest rates, rent increases and rising energy bills are putting pressure on household budgets. Extending the loan term to 40 years can help ease financial pressures by lowering repayments, which may appeal to borrowers who are focused on managing day-to-day costs, even though it means paying more interest over the life of the loan.

- Challenges facing first-home buyers: For first-home buyers who are struggling to save a large deposit or meet assessment criteria, a 40-year mortgage can make repayments more manageable and provide a pathway into the property market sooner. While this can help buyers secure a home earlier, it also means committing to a significantly longer period of debt.

In addition to the above, since mortgage regulator, APRA, increased serviceability buffers (meaning lenders must assess borrowers as if rates were 3 percentage points higher) many Australians could find it more challenging to qualify on their current income. The buffer was introduced to ensure borrowers can withstand future rate increases.

By extending the loan term to 40 years, lenders can reduce the assessed monthly repayment, allowing some borrowers to meet assessment requirements they would fail on a 30-year loan term.

What you can expect to repay on a 40-year mortgage

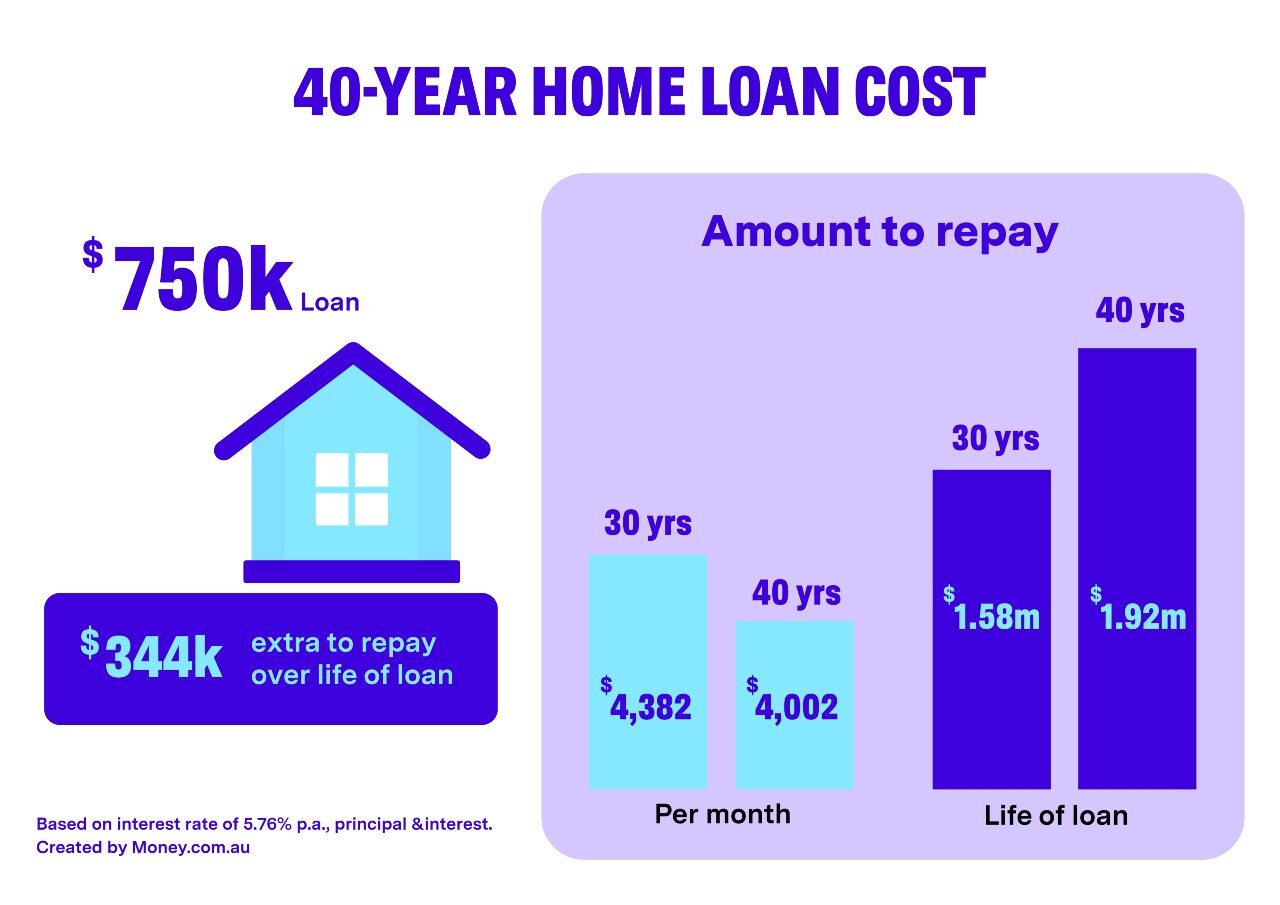

A longer loan term means lower monthly repayments, but more interest paid over the life of the loan. To put this into perspective, the table below shows you how much interest you can expect to pay for a standard 30 year loan compared to a 40-year loan.

| 30-year mortgage | 40-year mortgage | |

|---|---|---|

Loan amount | $750,000 | $750,000 |

Interest rate (p.a) | 5.76% | 5.76% |

Monthly repayment | $4381.56 | $4001.83 |

Total repaid over term | $1,577,362.34 | $1,920,876.23 |

Total interest paid | $827,362.34 | $1,170,876.23 |

The comparison between 30-year and 40-year mortgages demonstrates a clear trade off. While extending the loan term reduces monthly repayments, the long-term cost rises dramatically. While 40-year home loans may improve affordability in the short term, borrowers will ultimately pay significantly more in interest and may carry mortgage debt well into their 60s and 70s.

Who should consider a 40-year mortgage?

For the right borrower, a 40-year mortgage could offer a pathway into the housing market. But for others, it could extend financial pressure, highlighting the importance of knowing whether a long-term loan aligns with your future financial and lifestyle plans.

“First home buyers appear to be the target market for 40-year loan terms as their incomes vs borrowing capacity at lenders assessments rates align to a longer loan term,” says Hays.

“40-year loan terms offered to older borrowers should be restricted due to risk and carrying debt over into retirement and having no or little suitable exit strategy in place to support this loan term.

“With an ageing population, this may put pressure on the government to support older people who still have a home loan in retirement with the cost of living.”

In short, 40-year mortgages may be:

Best suited to:

- Younger borrowers who have their whole working lives ahead of them

- First-home buyers who are otherwise priced out of the market

- Borrowers who intend to pay extra, refinance or restructure their loan down the track

Less suited to:

- Borrowers close to retirement

- Investors (as most lenders restrict 40-year mortgages to owner-occupiers)

- Borrowers looking to minimise long-term interest costs

How could a longer mortgage impact your retirement plans?

Before locking in a 40-year loan, consider what it means for your future self

With the term of a 40-year mortgage being so much longer than a standard loan, it’s important to consider the impact it may have later in life, particularly when it comes to retirement.

Are 40-year mortgages the future of lending?

As housing affordability continues to challenge borrowers, lenders are adapting, and 40-year mortgages are emerging as one of the responses.

But what does this mean for the housing market and borrowers moving forward as extended loan terms become more common.

“With increased loan terms, the risk is increased loan amounts as borrowers' servicing capacity is increased along with property prices in Australia,” Hays explains.

“Build up of equity in a property is reduced as increase in interest component of designated principle and interest repayments are amortised over a 40 year loan term and net equity position is decreased on sale."

For now, 40-year mortgages offer a pathway into the housing market for some borrowers. But they also highlight the growing need for long-term, sustainable solutions to Australia’s housing affordability crisis.

Debbie Hays, Senior Mortgage Broker at Money.com.au

“Older borrowers may be priced out of the market due to extended loan terms, causing pressure on the government and benefits.”

Debbie Hays, Senior Mortgage Broker at Money.com.au