Home Loan research & insights

Money.com.au conducts regular consumer surveys and in-depth data analysis to uncover how Australians buy property, finance their homes and manage their mortgages.

Research is compiled by our experienced PR & Editorial team. Updated 5 Mar 2026.

Below you’ll find the latest Money.com.au home lending research, ordered from most recent to least.

All surveys are independently commissioned and carried out by a third-party research agency. Each study is nationally representative by age, gender and location.

Our research is frequently featured across major news outlets and is designed to help Australians make more informed financial decisions, but also to support journalists and policymakers with data-driven insights.

If you use this information, please include a link to the page you’re currently on: https://www.money.com.au/home-loans/research-insights

Home loans research & insights

Renters fork out $4,700 in ‘moving tax’

It’s not just rising rents Aussies are grappling with — new data shows moving costs are also taking a growing toll.

New research from Money.com.au reveals renters moved home roughly every three years on average and spent about $4,700 on moving costs over the past decade. That’s equivalent to $1,567 per move.

One in five renters (20%) reported spending between $5,000 and $10,000 on moving costs over the same period.

Money.com.au’s Property Expert, Nick Burgess, says the cost of moving is adding another layer of financial pressure for renters.

“Moving costs like removalists, bond payments and overlapping rent creates a serious financial burden for renters. It compounds the pressure from rising weekly rents and tight rental supply in recent years,” he says.

“If you’re a renter who has to move at the end of every lease to avoid a rent hike, or you’re moving interstate or relocating across major cities, moving costs can quickly become prohibitive. I’ve seen cases where a couple spent $7,000 to move from Brisbane to the Gold Coast, and another family spent $5,000 relocating from Geelong to Melbourne for work.”

“If rent money is considered ‘dead money’, then the moving tax can be a silent killer because it’s thousands of dollars renters spend every time they relocate, and over the years those costs really snowball.”

“When you put it in perspective, the average rental moving cost of $4,700 is roughly one-tenth of a 5% deposit on the median combined house and unit price of $883,000. You could argue that’s another barrier to homeownership for some renters.”

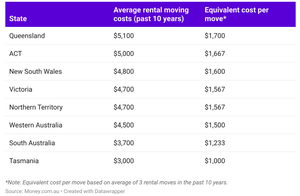

Where it costs the most to move rentals in Australia

Queensland renters paid the most to relocate, averaging $5,100 over the past decade (about $1,700 per move). The ACT followed at $5,000 ($1,667 per move), ahead of New South Wales ($4,800 / $1,600 per move) and Victoria ($4,700 / $1,567 per move), with the Northern Territory on par ($4,700 / $1,567 per move).

Queensland renters paid the most to relocate, averaging $5,100 over the past decade (about $1,700 per move). The ACT followed at $5,000 ($1,667 per move), ahead of New South Wales ($4,800 / $1,600 per move) and Victoria ($4,700 / $1,567 per move), with the Northern Territory on par ($4,700 / $1,567 per move).

Western Australia ($4,500 / $1,500 per move) and South Australia ($3,700 / $1,233 per move) were lower, while Tasmania was the cheapest at $3,000 over the decade (about $1,000 per move).

Removalists and bonds top renters’ financial pain points

Nearly half of renters said removalist fees (45%) and having to pay a new bond before the old one is returned (44%) are the biggest financial pain points when moving.

Other common pressures include paying rent on two properties at once (27%) and end-of-lease cleaning costs (24%), while fewer renters pointed to time off work (9%) and utility reconnection fees (7%) as major stressors.

Millennials hit hardest by moving costs

Millennials paid the highest ‘moving tax’, averaging $5,300 over the past decade — well above Gen X ($4,600), Gen Z ($4,300) and Baby Boomers ($4,200).

-- ENDS --

| State | Average rental moving costs (past 10 years) | Equivalent cost per move* |

|---|---|---|

Queensland | $5,100 | $1,700 |

ACT | $5,000 | $1,667 |

New South Wales | $4,800 | $1,600 |

Victoria | $4,700 | $1,567 |

Northern Territory | $4,700 | $1,567 |

Western Australia | $4,500 | $1,500 |

South Australia | $3,700 | $1,233 |

Tasmania | $3,000 | $1,000 |

49% of borrowers pulled plug on mortgage switch after current lender's last-ditch offer

New research from Money.com.au reveals nearly half of mortgage holders (49%) u-turned on their plans to switch lenders after being offered a lower interest rate by their bank’s retention team.

The nationally representative survey found just 23% of mortgage holders proceeded to switch banks despite receiving a competitive counter-offer from their current lender during their most recent refinance.

Meanwhile, only 28% of Australians said they were not offered a better rate by their lender.

Money.com.au’s Mortgage Expert, Debbie Hays, says lenders often sharpen their pricing when a borrower signals they’re ready to walk.

“Retention teams often have limited pricing authority and a ‘floor rate’ they can offer based on your loan size and loan-to-value ratio. If you stick to your guns, your file can be escalated to a supervisor with discretion to apply a bigger discount,” she says.

“I recently had a borrower who was offered a lower rate and cashback from a new lender. Once their bank chimed in with a retention rate on par, they chose to stay. They’d been with that bank for more than 10 years. In this case, it was in their interest to stay and avoid refinancing costs like discharge and government fees.”

“In most cases, the best you can hope for is your bank matching the competitor’s rate, they rarely beat it. However, big-bank customers may find their lender’s retention rate still sits above what’s available elsewhere in the market or from a second-tier lender.”

Mortgage Broker, Nick Burgess, says some retention rates are genuinely competitive.

“I had a borrower who wanted to refinance out of Bankwest, but the retention team came back with a 0.35% discount on their existing rate. On a $892,000 loan, that saved them about $200 a month. It was a ‘stay’ deal that couldn’t be beaten elsewhere. These are the kinds of retention discounts some banks can offer but will never advertise,” he says.

Broker reveals sneaky retention tactics to watch out for

While retention deals can deliver real savings, there are a few sneaky bank tactics borrowers should watch out for.

- They offer you a fixed-rate alternative Some retention teams won’t match a competitor’s variable rate but will offer you a sharper fixed rate instead. This comes with strings attached like locking you in for another year or more and capping extra repayments. Nick says that from a lender’s perspective, it’s a double win. “They lock you in, so you can’t switch without hefty break costs, and they protect their revenue,” he says.

- Final-stage pricing offer Some lenders don’t come to the table until they see genuine ‘exit signals’. Banks’ retention teams only sharpen their pricing after you lodge a formal discharge request. Nick says some lenders even hold back their most competitive rates until the refinance is already progressing through solicitors or visible in the PEXA online settlement system.

- Internal product switch offers Rather than dangle a lower rate to keep your business, some banks may steer you toward a ‘special internal offer’ or cashback retention deal instead. In some cases, they may suggest switching between package and basic loan products instead.

- The ‘review later’ delay Some lenders may promise to review your rate in a few months rather than offer their sharpest retention rate immediately. In some cases, you may receive a small upfront discount with the promise of further reductions later.

Most borrowers say banks aren’t reviewing their rates

The research found the majority of Australian homeowners (62%) report their lender has never offered them a rate review outside of a refinance, compared with 38% who say they have.

-- ENDS --

7 in 10 Aussies have red flag habits that can hurt their lender ‘character’ check

New Money.com.au research reveals a whopping 70% of Australians have at least one spending habit that could hurt their ‘character’ check with a lender.

Among this group, nearly half (47%) recently spent money on lottery tickets or scratchies, while 30% reported buying alcohol more than twice a week. Nearly one in four Australians spent money on gambling or betting services (23%), or on smoking or vaping products (23%). A smaller share (5%) reported spending on adult content services, including platforms like OnlyFans.

The nationally representative survey of more than 1,000 Australians found just 30% reported none of those spending behaviours.

The five Cs of credit and where ‘character’ fits

Lenders assess every mortgage application based on the five Cs of credit: Collateral (the property securing the loan), Capacity (whether you earn enough to repay it), Capital (the value of your assets), Conditions (any factors that may affect the loan), and Character — how responsibly you manage your money and debts.

While the character assessment is mainly based on your credit history, it also considers spending habits that may flag ‘addictive’ or ‘risky’ behaviour.

Money.com.au’s Mortgage Expert, Debbie Hays, says lenders don’t just look at income and credit scores, they also analyse how borrowers actually spend their money.

“Banks will comb through three months’ worth of bank statements and pay close attention to any spending red flags. They will generally question recurring or excessive purchases, particularly gambling and smoking, but in some rare cases booze too," she says.

“I had a client who had declared living expenses at around $3,500 per month, but his actual living expenses were well over $6,000 per month, with the majority spent at BWS and Smokemart. He was shocked. His actual living expenses blew out his servicing position and his application would have been declined by the selected lender.”

“Lenders scrutinise these behaviours, but they won’t automatically reject an application, unless they see a pattern that could derail your ability to make repayments. Remember that banks must operate under strict responsible lending obligations. If they do reject a loan for failing the character assessment, they will generally tell you that the decision is based on spending patterns and serviceability concerns, not a single transaction.”

The research found that only half of Australians (50%) are aware that lenders assess a borrower’s ‘character’ as part of a home loan application.

How spending habits differ by generation

According to the survey, Gen X are the most likely to have at least one spending habit that could hurt their ‘character’ check with a lender, led by spending on lottery tickets and scratchies (57%), the highest of any age group.

Millennials lead alcohol purchases, with 38% spending on booze more than twice a week, and also top spending on adult subscription services (9%).

Gen Z stands out for higher-risk habits, with 30% reporting gambling or betting activity and an equal share spending on smoking or vaping products (30%).

By contrast, Baby Boomers recorded the lowest rates across all spending categories.

-- ENDS --

46% of homebuyers roll stamp duty and upfront fees into their mortgage, survey finds

For many Australians, it’s not just the deposit that’s hard to save — it’s the stamp duty and buying fees too.

New research from Money.com.au reveals half of Australian homebuyers (46%) increased their mortgage to help fund government charges like stamp duty and other buying fees.

Among this group, 28% increased their home loan to cover all upfront costs, including stamp duty, conveyancing and settlement-related fees, while 18% increased their loan to cover stamp duty only, which is often a five-figure sum.

The remaining 54% of Aussie homebuyers paid all government fees and buying costs separately.

Stamp duty is often the single biggest upfront cost outside the deposit

Money.com.au’s Mortgage Expert, Debbie Hays, says bundling stamp duty and fees into a home loan can help buyers get into the market sooner, but it comes with a long-term trade-off.

“If you’re a first home buyer who doesn’t qualify for an exemption, stamp duty and buying fees can feel like paying a second deposit. Many of those young buyers then roll those taxes and fees into their mortgage and take on a bigger debt than they originally planned,” she says.

“The real sting in the tail is you’ll pay interest on that extra amount over a 30-year term, because stamp duty and fees become part of your loan balance.”

“Sometimes financing those upfront costs is the only way people can buy a home, but buyers should have a plan to reduce the interest, like using an offset account or redraw. When the property grows in value, the equity can put them in a better position to refinance or restructure their loan down the track to pay less interest.”

For investors, Debbie says rolling upfront buying costs into the loan is often viewed differently.

“For investors, rolling stamp duty and upfront costs into the loan is a strategic play. In most cases, the extra interest on the loan is tax-deductible.”

Younger homebuyers most likely to borrow for upfront costs

The survey found that rolling upfront buying costs into a mortgage was most common among younger Australians. Nearly two-thirds of Gen Z homebuyers (64%) borrowed extra to cover costs like stamp duty and other purchasing fees, followed by 54% of Millennials.

“First home buyer exemption thresholds haven’t kept pace with rising house prices, which means many younger buyers miss out on stamp duty relief and end up adding stamp duty and other fees into their loan.”

The share was much lower among older homebuyers, with 39% of Gen X and 27% of Baby Boomers saying they did the same.

-- ENDS --

More than 1 in 3 homeowners plan to lock in fixed rates ahead of more 2026 hikes

New research from Money.com.au reveals more than one in three mortgage holders (35%) plan to lock in a fixed rate in 2026, ahead of more rate hikes.

Among those planning to fix, 23% intend to lock in their rate for two years or longer, while 12% plan to fix for at least one year.

In contrast, most mortgage holders (56%) say they’ll stay on a variable rate and ride out any rate uncertainty, while a smaller share (9%) plan to split their loan between fixed and variable as a hedge.

Money.com.au’s Mortgage Expert, Alex Dore, says rate uncertainty is pushing mortgage holders towards fixed loans.

“Banks have already been quietly lifting fixed rates, which suggests they’re pricing in multiple rate hikes in 2026. While there are still some fixed rates lingering in the low fives, those sharper deals won’t be around for much longer.”

“Traditionally, borrowers rush to fix when rates are at rock-bottom. But the other moment people tend to lock in is when uncertainty peaks, and right now, a lot of homeowners are choosing certainty over their monthly outgoings above anything else.”

Younger borrowers lead the rush to fix

The research found that Gen Z is the most likely generation to fix their mortgage, with 61% planning to lock in a rate ahead of more 2026 hikes. Millennials followed at 45%, compared with 28% of Gen X borrowers and just 10% of Baby Boomers.

-- ENDS --

Survey: 1 in 5 homeowners underestimate living expenses on their mortgage application

New research from Money.com.au reveals that one in five homeowners (20%) underestimated their living expenses when they applied for a mortgage, and for some it was enough to cost them the loan.

Within this group, 12% said they unintentionally underestimated their expenses but a broker or lender flagged it and the loan still proceeded. A smaller portion (8%) had their home loan application rejected outright as a result of the error.

Some homeowners underestimated their monthly spending by more than $1,000 — a shortfall large enough to push borrowers below the serviceability threshold.

Money.com.au’s Mortgage Expert, Debbie Hays, says many borrowers aren’t keeping close enough track of what they earn and spend, and even small inaccuracies can jeopardise a mortgage application.

“Most people don’t know how much they spend each month. More often than not, mortgage applicants will have an estimate of their living expenses, and when you go through their bank statements, you find glaring inconsistencies. You want to find those errors before you submit your loan application,” she says.

“Lenders will scrutinise every line of your bank statements, so if the figures don’t match what you’ve declared, whether the mistake is accidental or intentional, it can derail your application or even lead to a rejection. This applies just as much to refinancing as it does to new loan applications, because they re-run the same serviceability checks every time.”

The survey found the majority of mortgage holders (69%) estimated their living expenses accurately on their loan application, while 11% admitted they actually overstated their living expenses.

Young Aussies most at risk of loan rejection due to living expenses blunders

Among those who underestimated their living expenses on their mortgage application, younger Australians were by far the most likely to get their figures wrong. Nearly two-thirds of Gen Z borrowers (62%) admitted to underestimating their costs, compared with one-third of Millennials (33%), 19% of Gen X, and just 8% of Baby Boomers.

Younger borrowers paid the highest price for their budget errors: 32% of Gen Z who underestimated their expenses had their home loan rejected, compared with 13% of Millennials.

How do banks assess living expenses on a mortgage application?

Lenders assess living expenses using the Household Expenditure Measure (HEM), which estimates your basic living costs based on income, relationship status and dependents. They compare this benchmark to the expenses you declare on your mortgage application and cross-check it against your bank statements for a period of three months.

If your bank statements show that you spend more than what you declared, lenders will use your actual spending. In some cases your real spending will still sit within the HEM benchmark. However, if it exceeds the HEM, it reduces your borrowing capacity and can even push you below the serviceability threshold, which may lead to the lender rejecting your application.

Debbie says low declared living expenses may be acceptable if:

- You’re self-employed and legitimately run some personal costs through the business

- You have high savings or a high income that clearly supports your lifestyle

- Your property has a strong equity position, which reduces the lender’s risk.

-- ENDS --

Survey: 52% of homeowners will struggle to afford Christmas and their mortgage

New research from Money.com.au reveals that more than half of Australia’s homeowners (52%) will struggle to afford both their mortgage repayments and Christmas spending this year.

Within this group, 37% will cut back on Christmas spending to keep up with their repayments, while 10% expect to rely on credit cards or BNPL services to make ends meet during the silly season. A smaller portion (4%) fear they may fall behind on their mortgage, and 1% say they’ll need to take a repayment holiday or seek hardship support from their lender.

Money.com.au’s Mortgage Expert, Debbie Hays, says many households are entering the festive season with rising costs and mortgage pressures hanging over their heads.

“Christmas is generally a great time for families, but for mortgage holders it’s equally a financial stress test. Even with the RBA cutting rates this year, many homeowners will have to make a trade-off between keeping up with their mortgage and maintaining their usual level of festive spending. Christmas is often difficult to cut back on when kids, family traditions and social pressures are involved,” she says.

“Some mortgage holders will simply scale back their Christmas spending, while others will rely on credit cards or BNPL services, or in some cases seek support from their bank. Lenders can receive more hardship requests during the Christmas season due to increased spending pressures.”

The survey found that only 49% of homeowners can comfortably afford both Christmas and their mortgage repayments this year.

Youngest and oldest homeowners feeling the Christmas mortgage crunch

Borrowers at both ends of the generational ladder are under pressure. Gen Z (61%) and Baby Boomers (57%) are more likely to struggle to afford both Christmas spending and their mortgage. This is followed by 52% of Millennials and 46% of Gen X who report the same.

5 tips on how to juggle your mortgage and Christmas spending

- Prioritise your mortgage repayments Make sure you can cover your mortgage repayments in December and January 2026 before you consider how much to spend at Christmas. Defaulting on your home loan — even once — can trigger fees and damage your credit score, and it may make refinancing much harder down the track.

- Review your home loan rate If it’s been more than a year since your last rate review, it’s worth speaking to a broker. Getting a lower rate on your mortgage could bring your repayments down and free up extra cash flow. Debbie says brokers often have direct relationships with lending teams, which can help them negotiate sharper rates and faster approvals before Christmas on your behalf.

- Be cautious with credit cards and BNPL Using credit cards or BNPL to get through Christmas can create longer-term financial stress. If you do rely on them, set clear repayment limits and avoid stacking multiple BNPL services at once. BNPL services are now treated as credit products, which means any missed payments may affect your credit score.

- Talk to your lender early if you’re struggling Banks have hardship teams that can temporarily adjust your repayments or offer alternative arrangements. Speak to your lender as soon as you think you won’t be able to meet your repayments, even for a short period. The earlier you reach out, the more options you’ll have. This may include deferring your repayments or making reduced payments for a short time. A temporary hardship arrangement will not affect your credit score.

- Ask for a repayment holiday Some home loans allow you to pause or reduce repayments if you’ve previously made extra repayments. If your mortgage offers this feature, it could provide temporary relief during the festive season. Just keep in mind that interest keeps accumulating during the break, which could add to your overall loan cost.

-- ENDS --

Survey: 30% of Aussies worried about how kids affect their mortgage application

New research from Money.com.au reveals nearly one in three Australians (30%) say having or planning to have kids made them more nervous about applying for a mortgage.

Among them, 22% were concerned about managing mortgage repayments alongside the extra costs of children, while 8% worried that having or planning to have children could reduce their borrowing capacity or affect their loan approval.

Lenders consider children or other dependents during the mortgage application process. The cost of caring for them is treated as an ongoing financial commitment when determining how much you can borrow.

Keys before kids: Homeownership takes priority

Money.com.au’s Mortgage Expert, Debbie Hays, says there’s a growing trend of homebuyers adjusting their family plans to maximise their borrowing capacity.

“There’s a real push-and-pull between family planning and buying a home, particularly among first-home buyers. We’re seeing more couples time their mortgage application around when they’re planning to start a family. In some cases, they delay having children once they find out how much dependents can reduce their borrowing power. They don’t want to risk being locked out of the market once kids are in the picture,” she says.

“It’s very different to our parents’ or grandparents’ generations, when people tended to start families first and buy a home later. Today, housing affordability pressures are flipping that timeline.”

“Having children reduces your borrowing capacity because they increase household expenses and leave less disposable income available for mortgage repayments. When lenders assess your application, they use the Household Expenditure Measure (HEM) to estimate your living costs, including childcare, education, food and clothing. The more dependents you have, the higher your assessed expenses, which ultimately reduces your borrowing capacity and total loan amount available.”

In contrast, 45% of Australians surveyed said having children wouldn’t influence how they feel about applying for a home loan, while 26% said they don’t have or don’t plan to have children.

Family planning weighs heaviest on Gen Z homebuyers

The research found that Gen Z were more likely than Millennials to feel anxious about how starting a family could affect their borrowing power, mortgage application, or loan repayments. Three in five Gen Zs (60%) said they felt this way, compared with 51% of Millennials.

The parenthood penalty: How kids can shrink your borrowing power

For a couple with a combined annual income of $180,000 and borrowing around $800,000 (assuming a 5% deposit and no LMI), adding children can make a significant difference to how much they can borrow, even if they have no other debts.

Based on standard lender serviceability calculations, one child could reduce their borrowing capacity by around $30,000–$55,000, while two children could cut it by as much as $90,000–$125,000.

-- ENDS --

Survey: Aussies spend half a decade renting before buying a home

New research from Money.com.au reveals Australians are stuck in the rental market for an average of six years before they can afford to buy their first home.

The nationally representative survey found that a quarter of first home buyers (26%) rented for 1–3 years before purchasing, while another 21% rented for 4–6 years.

At the other end of the spectrum, 12% rented for more than a decade before buying, and a further 9% rented for 7–10 years. Only 9% of Australians rented for less than a year before purchasing their first home.

Meanwhile, 22% of Aussies skipped renting altogether and lived at home with their parents until they could buy their first property.

Money.com.au’s Mortgage Expert, Debbie Hays, says renters don’t have to wait as long as they previously did to break into the property market.

“In the past, many Aussies spent most of their 20s and 30s renting while trying to save for a deposit. Now, some lenders recognise regular rent payments as ‘genuine savings’ towards your 5% minimum deposit, which can help renters get on the property ladder sooner, as long as they can show they can afford the loan,” she says.

“By counting regular rent payments as a portion of genuine savings, lenders are giving reliable tenants a bridge into home ownership. In their eyes, a reliable tenant is likely to be a reliable borrower too. Some banks introduced these policies a few years ago after recognising how difficult it’s become for Australians to maintain even a 5% deposit while juggling rising rents, living costs and property prices.”

Where Aussies rent the longest before buying a home

The time it takes to transition from renter to homeowner varies marginally between states. South Australians spend the longest in the rental market, averaging 7 years before buying their first home. In New South Wales and Queensland, aspiring homebuyers spend around 6.5 years renting before purchasing, while those in Victoria and Western Australia make the jump a little sooner, after an average of 6 years.

How your rental history could help you buy a first home

Along with sufficient income, most lenders require you to have at least 5% of the property’s value saved in a bank account for three months before applying for a home loan. However, if you’ve been renting for at least six months and have a strong record of on-time payments, some lenders may count your rental history toward the minimum 5% genuine savings requirement, provided you’ve previously held that amount in savings.

Policies vary between lenders, but to have your rental history counted as evidence of genuine savings, you’ll generally need to provide:

- A copy of your current lease agreement

- A rental reference letter from your property manager verifying your payment history, or a rental ledger showing on-time payments for at least six months.

-- ENDS --

Survey: Aussies question RBA’s control over inflation and cost of living

New Money.com.au research reveals many Australians are sceptical that the RBA has a firm grip on inflation and the nation’s cost pressures.

The nationally representative survey of more than 1,000 Australians found that 35% believe the Reserve Bank is falling short in managing inflation and the cost of living. This is despite inflation moderating slightly this year and the RBA easing pressure on borrowers with three rate cuts.

The research found 37% of Australians are still undecided about the RBA’s performance on those issues, while 28% say it’s managing inflation and the cost of living effectively.

Money.com.au’s Finance Expert, Sean Callery, says public confidence in the Reserve Bank’s approach to monetary policy is showing cracks.

“Inflation is still sticky despite the RBA’s best efforts and households are still feeling the squeeze as price pressures linger across essentials. This is causing Aussies to question whether the RBA has its hand firmly on the wheel. Many households feel the cost of living hasn’t eased enough to justify optimism, while others see steady progress and think the Reserve Bank is on the right track. Only time will tell which view proves correct,” he says.

Millennials and mortgage holders lead criticism of RBA’s inflation handling

The survey found that the cohorts most critical of the RBA were Millennials (45%) and mortgage holders (39%), who were the most likely to say it’s not doing enough to manage inflation and the rising cost of living. Sentiment among renters was similar, with 37% saying the RBA is falling short.

Meanwhile, Baby Boomers (42%) and Gen Z (39%) were more likely to say they’re still undecided.

-- ENDS --

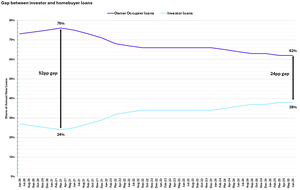

Mortgage Insights Report analysis: Property investors hold record mortgage share as gap with homebuyers shrinks

New analysis from Money.com.au reveals property investors hold their largest share of the mortgage market since the ABS began records.

Property investment loans make up 38% of all new lending (196,699 loans) in the year to June 2025, while owner occupier loans account for 62% (324,972 loans), ABS data shows. In other words, investor lending is trailing homebuyer loans by just 24 percentage points. It’s the closest gap between the two buyer segments since the ABS began tracking investor loans in 2019.

It’s a notable shift considering that just four years ago, property investors held their smallest share of all new lending — only 24% (121,789 loans) in the year to March 2021, compared with 76% (380,488 loans) for owner occupiers. Investors were trailing homebuyers by 52 percentage points, more than double the current gap.

Impact on housing affordability

Money.com.au’s Mortgage Expert, Debbie Hays, says the investor segment closing in on homebuyers marks a turning point in Australia’s property cycle.

“It means the homebuyer segment is becoming less the backbone of the market. Investors are now playing a much larger role in shaping house prices, affordability, supply and even influencing housing policy. It wouldn’t surprise me if the government once again raised the prospect of negative gearing reforms to level the playing field,” she says.

“Investors taking a larger share of the market is a double-edged sword. On one hand, it signals all-time high confidence in property as an asset class. On the other hand, it means first-home buyers and owner occupiers are competing with equity-rich buyers, which will inevitably push prices higher and widen the affordability gap.”

Traditionally, property investors have taken on larger debts, but that gap has also narrowed. Investors now carry an average annual loan size of $667,512, almost identical to the $661,534 for owner occupiers.

Impact on rental affordability

Debbie says the rise in investor lending will have a flow-on effect on the rental market.

“More investors coming into the market can add to rental supply, since many of those properties end up in the rental pool. In theory, that should give renters more choice,” she says.

“But with demand for rentals already outstripping supply, a surge in investor activity can only fuel higher rents. Investors will look for higher rental yields to service their larger loans, and that translates into higher asking prices for tenants.”

-- ENDS --

Survey: 57% of mortgage holders have never checked whether their mortgage offset account is correctly linked to their home loan

New research from Money.com.au reveals the majority of mortgage holders (57%) have never checked whether their mortgage offset account is correctly linked to their home loan, potentially costing them thousands in interest.

Additionally, the survey found that one in ten borrowers (10%) thought their offset would be automatically linked to their home loan by their lender.

Only a quarter of mortgage holders surveyed (25%) said they had checked and confirmed their offset account was linked, while a further 9% discovered it wasn’t linked and fixed the issue.

It comes as ASIC investigates potential offset-account mislinking issues across the banking sector. The regulator’s probe will span eight lenders’ mortgage books to determine whether customers are receiving the benefits they’re entitled to from their offset accounts.

An offset account helps you pay less interest on your home loan because interest is only charged on the difference between your loan balance and the money in your offset.

If it isn’t linked correctly, the money sitting in that account won’t offset your loan balance, meaning you’ll end up paying more interest than you should.

Money.com.au’s Mortgage Expert, Debbie Hays, says most borrowers assume their offset account is automatically linked to their home loan, but that’s not always the case.

“We recently had a homeowner who received an inheritance and deposited $340,000 into their offset account, only to discover 12 months later that the account wasn’t actually linked to their variable home loan. The interest savings they thought they were getting weren’t in place at all. It’s just lucky they caught it early and not 10 years down the track,” she says.

“Offset mislinking can happen for a range of reasons ranging from administrative errors to account changes during refinancing, but it’s ultimately the borrower who pays the price. Lenders need to ensure their systems are set up properly, but borrowers also have a responsibility to double-check. A quick look at your loan statement or internet banking could save you a lot of money.”

Offset mistake could add more than $111,000 in mortgage interest

A borrower with a $600,000 mortgage at 5.50% p.a. with $30,000 sitting in their offset account could pay $111,620 in extra interest over 30 years if their offset isn’t properly linked. This assumes the rate stays the same and no extra repayments are made.

It would also mean staying in debt for an extra 2 years and 8 months compared to a correctly linked offset account.

Older Aussies lag behind in checking offset accounts

The survey found that Baby Boomers are the least likely to check their offset account, with 69% saying they’ve never confirmed whether it’s linked to their mortgage. This compares with 58% of Gen Z, 50% of Gen X, and 47% of Millennials.

“Older Australians have been paying their mortgages for decades, so if their offset hasn’t been linked correctly that could mean years of lost interest savings. That’s money they may not be able to recover if the issue wasn’t detected early,” says Debbie.

How to check if your offset account is linked to your home loan

To check if your offset account is linked to your home loan, log in to your online banking or banking app and look for a section called ‘Mortgage Offset’ or ‘Linked Accounts’. If your offset account number appears there, it means it’s linked to your home loan.

Alternatively, check your home loan statement. It should show the interest charged each month, followed by an offset adjustment or similar line item. Having money in your offset won’t change your repayment amount (unless you’re on interest-only repayments), but the interest charged should be lower when there are funds in your offset account.

What to do if you find out your offset account isn’t linked

Debbie says you should call your bank directly and ask them to confirm whether your offset account is correctly linked to your home loan and from what date. “If it isn’t linked, ask them to backdate the connection to when your home loan settled,” she says.

Are you entitled to compensation if your offset account wasn’t linked?

If you discover that your offset account hasn’t been linked to your home loan, you may be entitled to a refund of the extra interest you were charged, depending on your lender’s policies and how long the issue went unnoticed.

Debbie says your lender should review your account and reimburse any extra interest charged due to their error, especially if you can show the offset was meant to be linked from the start.

“If they don’t, you can escalate the matter by lodging a complaint with your lender’s internal dispute resolution team and if it remains unresolved, it will proceed through to AFCA for review,” she says.

-- ENDS --

Survey: 1 in 3 Aussies say their home loan extras are confusing or not worth the fees

New research by Money.com.au reveals that one in three Australians (34%) say their home loan extras, like offset accounts or bundled cards, are either too confusing or not worth the fees.

In comparison, two-thirds of borrowers (66%) whose home loan comes with additional features believe they offer good value.

Home loan extras are added features that come with your loan like offset accounts, bundled credit or debit cards, and fee waivers. These are often included in package loan products that offer a discounted rate, but they typically come with higher fees.

Money.com.au’s Mortgage Expert, Debbie Hays, says more borrowers are ditching home loan extras and package loans to avoid unnecessary fees.

“We find that many borrowers don’t use their offset accounts enough to justify the $10 monthly fee or the $395 annual package fee. Others don’t have enough savings in those accounts to benefit from the offset, so they’re switching to a basic loan with a redraw facility, which works in a similar way to reduce interest, but with no added fees,” she says.

“If your home loan includes an offset account, check that the interest rate is competitive and that the fees don’t outweigh the interest savings.”

Overall, the survey found that 62% of Aussie borrowers have a package home loan with extras, while 38% have opted for a basic loan with no frills.

How loan feature fees could slice $1,975 off your savings

Take a borrower with a $600,000 loan over 30 years and $10,000 sitting in their offset account. At a 5.50% interest rate, they’d save around $6,790 in interest over five years and shave 11 months off their loan term.

However, if that offset account is part of a package loan with a $395 annual fee, the total fees over five years would be $1,975 — bringing the net savings down to $4,815.

By comparison, putting the same $10,000 into a redraw facility on a basic home loan with no ongoing fees would give you the full $6,790 in interest savings, as long as you keep up your regular repayments and don’t touch the money.

Millennial borrowers most confused by home loan extras, but still paying for them

The survey found that Millennials were the most likely to question the value of their home loan extras — 35% say the features either aren’t worth the cost or they don’t understand what they’re paying for.

Baby Boomers followed closely at 34%, while 33% of Gen Z and 32% of Gen X also said their home loan extras are confusing or not worth the fees.

-- ENDS --

Survey: 47% of homeowners who refinance their mortgage reset their loan term to 30 years

New research from Money.com.au reveals that nearly half of homeowners who refinanced their mortgage (47%) reset their loan term back to 30 years.

Resetting the clock on your mortgage lowers monthly repayments, but it also means paying more in interest over the life of the loan and staying in debt longer.

Meanwhile, the survey found that 8% of homeowners who refinanced weren’t aware their lender had extended their loan term to 30 years until after the fact.

Money.com.au’s Mortgage Expert, Debbie Hays, says homeowners may be chasing short-term savings from resetting their home loan term which can come at a steep long-term cost.

“Yes, it feels like a win because it reduces monthly repayments, but it’s really a false economy. You may save a few hundred dollars a month now, but you’re signing up for tens of thousands in extra interest over time and adding back years to your loan when the goal is generally to pay it off sooner,” she says.

“Resetting the clock on your home loan back to 30 years in some instances only really benefits the banks, and not the borrower. For many Australians, that means carrying debt into retirement, and that’s a situation that can seriously limit financial freedom later in life.”

“If your mortgage is set back to 30 years inadvertently, don’t panic. You can make additional repayments or keep your monthly payments at the higher level you were already managing. That way, you won’t pay any extra interest and you’ll shave years off your loan.”

The survey found that 41% of homeowners who refinanced their mortgage chose to keep their original loan term.

Resetting your loan term to 30 years will reduce your monthly repayments, but will mean paying more interest overall.

For example, if a borrower with a $600,000 home loan and 25 years remaining at 5.70% refinanced to a lower 5.50% rate but reset the term to 30 years, their repayments would fall by $349 a month. However, they would pay an extra $121,067 in interest over the life of the loan compared with keeping the original 25-year term at the lower 5.50% rate.

When resetting your home loan term to 30 years makes sense

Debbie says there are scenarios where resetting a loan term back to 30 years makes sense.

“In some cases, extending your loan term can form part of a wealth-creation strategy. For example, if you’re upgrading to a new home and turning your current property into an investment, you might extend the loan term and switch the investment loan to interest-only repayments. This can free up cash flow, maintain your investment debt for potential tax benefits and allow you to direct more of your available cash toward the new owner occupied mortgage,” she says.

“For families under heavy cost-of-living pressure, resetting your home loan to 30 years to lower monthly repayments can provide essential breathing space in the short term. They can then make extra repayments later when they’re in a stronger financial position.”

If you’re refinancing with a broker or directly with a lender, do your due diligence and ask what the repayment is over a revised 30 year loan term and compare it to what you’re currently paying.

-- ENDS --

Survey: 1 in 3 homeowners default to bank-set lower repayments

New research from Money.com.au reveals that a third of homeowners (33%) let their bank automatically lower their mortgage repayments after a rate cut, instead of keeping them the same to pay off their loan faster.

Meanwhile, 7% of homeowners request a repayment reduction from their lender after a rate cut.

While lower repayments reduce monthly outgoings, your loan takes longer to pay off, and you end up paying more interest overall.

In comparison, the survey found that 39% of borrowers keep making the same repayments after a rate cut because their lender doesn’t automatically reduce them. One in five (21%) actively ask their lender to keep their repayments the same to pay their loan off faster.

Money.com.au’s Mortgage Expert, Debbie Hays, says borrowers should think beyond short-term savings when it comes to their mortgage.

“Letting your lender automatically reduce your repayments might feel like a win because it frees up cash in the short term, but it comes with a big opportunity cost. You’ll slow down your loan progress and pay thousands more in interest over time,” she says.

“If your lender lowers your repayments by default after a rate cut, you don’t have to accept it. You can request to keep paying the original amount, and if you can afford it, I always recommend doing so to pay off your mortgage faster.”

“This is especially important in the first five to 10 years of your mortgage, when most repayments go toward interest rather than the principal. Because interest is front-loaded, lowering repayments early on slows your ability to chip away at the actual debt. By keeping repayments steady during this stage, you can dramatically reduce your total interest bill and knock years off your loan.”

How much could you save by keeping your repayments the same after a rate cut?

Here’s a hypothetical example of how much a borrower could save on interest over time and shave off their loan term.

Following August’s rate cut, a borrower with a $600,000 mortgage over 25 years will see their monthly repayments drop by $108, assuming a new rate of 5.49%. But if they keep their repayments at the pre-cut level, they could pay off their loan a year sooner and save $32,464 in interest.

When combining all three rate cuts this year, a borrower with a $600,000 mortgage would see their monthly repayments fall by around $273. But if they choose to keep their repayments at the original amount, they could shave more than three years off their loan, and save $82,009 in interest.

While some lenders automatically lower repayments when interest rates drop, others leave repayments unchanged by default and require borrowers to request a reduction if they want to pay less. Keeping repayments the same can shave years off a home loan and reduce interest by thousands of dollars.

-- ENDS --

Survey: 29% of first-home buyers used their parents’ lender or home loan recommendation

We’ve long known the Bank of Mum and Dad helps fund home deposits — but new Money.com.au research shows parental influence stretches even further into the home loan process.

The nationally representative survey found that nearly one in three Australian first-home buyers (29%) went with the same lender their parents used or a home loan product they recommended.

The majority of Aussie first-home buyers (71%) made their mortgage decision independently, either solo or with the help of a broker.

Money.com.au’s Mortgage Expert, Debbie Hays, says trust is often a major factor for young Australians who are influenced by their parents when it comes to their first mortgage.

“A lot of young homebuyers engage a broker but are already set on a lender their parents have recommended, often because it’s the bank that’s held the family’s mortgage for years or helped with their parents’ refinancing. There’s a family trust factor there,” she says.

“But the lender or loan product Mum and Dad chose won’t necessarily be right for you as a first-home buyer. If you’re entering the market for the first time, you’ll likely have a unique borrower profile. You might have a high loan-to-value ratio, be applying for government incentives, or be using a cash gift as part of your deposit. Lenders have different policies around all these factors. That’s why you should compare options yourself or speak with a broker who understands the market.”

Gen Z most likely to turn to Mum and Dad for mortgage advice

The survey found that Gen Z (those aged 18 to 25) were the most likely to be influenced by their parents when applying for their first mortgage. Nine out of ten (90%) said their parents shaped the decision, either by recommending their own lender or suggesting a specific loan product.

By comparison, only 44% of Millennials (those aged 26 to 41) said their parents had a say in their first mortgage decision.

Parental advice also shaping property choice

Additionally, one in five first-home buyers (20%) let their parents weigh in on where or what they bought — whether it was the suburb, the type of property or both. Overall, 28% of Gen Z and 29% of Millennials said Mum and Dad helped shape their final property decision.

-- ENDS --

Survey: First-home buyers reveal their biggest mortgage regrets

Mistakes are bound to happen the first time you do anything and taking out a home loan is no exception. New research from Money.com.au reveals the most common regrets first-home buyers have about their mortgage.

The survey found that paying too much in loan processing and ongoing fees was the most common mistake, cited by 22% of Aussie first-home buyers.

This was followed by not being on a competitive interest rate (21%), choosing a loan without offset or redraw features (16%), not understanding the product they signed up for (15%), and not using a broker or using the wrong broker (13%).

Smaller proportions regret locking in a bad fixed rate (6%) or taking the advice of parents or family on which loan to choose (6%).

Money.com.au’s Mortgage Expert, Debbie Hays, says too many first-home buyers lock in with the first lender they approach, rather than shopping around for a better deal.

“Many first-time home buyers apply for a loan with the first lender they come across, often their existing bank or their parents’ bank. They haven’t yet built the habit of shopping around or getting advice from a broker. In that haste, they often overlook fees, loan features or whether the rate is even competitive. Once they catch their breath, they often realise they could have secured a better deal, or that the loan they chose doesn’t suit their long-term needs,” she says.

“That’s why we get a lot of first-home buyers refinancing within a year of getting their mortgage. By then, they’ve usually improved their loan-to-value ratio, gained experience with loan products and features, and become more assertive about what they want or don’t want from a lender. Many are also confident enough to haggle and push for establishment fees to be waived on their next loan.”

Gen Z stung by fees, Millennials by complexity, Gen X by high rates

The survey reveals that 28% of Gen Z first-home buyers said their biggest mistake was paying high loan processing and monthly fees.

Among Millennials, one in four (25%) regret not fully understanding the loan product they signed up for.

Gen X first-home buyers were the most rate-conscious, with 38% saying their main regret was not being on a competitive interest rate.

On a $600,000 mortgage over 30 years, even a small change in interest rate and fees can save first-home buyers thousands over the life of their loan. For example, a mortgage with a 5.70% rate and $4,450 in fees over the loan’s life would cost borrowers $31,341 more than a 5.50% loan with lower lifetime fees of $350.

The difference in monthly repayments is $76, with borrowers on the higher rate paying $3,482 a month compared to $3,406 on the lower-rate loan.

-- ENDS --

Mortgage Insights Report analysis: Mortgage market won’t return to peak until 2036, new projections show

Home lending may be bouncing back on the back of multiple rate cuts and easing borrowing conditions, but the road to recovery is tipped to be slower than expected.

New analysis by Money.com.au reveals it could take more than a decade for Australia’s mortgage market to return to its previous heyday, when more than 1,300 home loans were being issued on average each day.

In fact, home lending won’t return to those levels until at least 2036, new projections show.

According to ABS lending data, owner occupier loans last peaked at 1,322 per day in the March quarter of 2021. This peak was fuelled by a record-low cash rate of 0.10% and government support measures during COVID.

Then, volumes fell by more than a third, to just 822 loans per day in the March 2023 quarter. That was when the Reserve Bank was in the midst of its rate-hiking cycle.

Now in 2025, loan numbers averaged just 890 per day in the June quarter. At the current pace of growth, home lending won’t return to its previous highs of around 1,300 loans a day until at least 2036, when volumes are projected to reach 1,327 per day in the March quarter.

By then, the average new home loan size is projected to reach $1,145,982 — up 69% from today’s average of $676,434.

Money.com.au’s Mortgage Expert, Debbie Hays, says the road to recovery for Australia’s mortgage market may be bumpy.

“The stimulus-fuelled peak of 2021 was short-lived, and led to a major trough which we’re still slowly digging our way out of. The fact it will take a decade to return to those levels under normal growth shows just how distorting housing bubbles can be to the wider market,” she says.

“There may also be smaller peaks and troughs along the way. These disproportionately affect homeowners and first-time buyers, who are the most exposed to swings in borrowing costs and property prices. When volumes surge, prices rise, and those without a foothold in the market are locked out.”

“The next peak will occur in a very different environment. Borrowers will be facing much higher average loan sizes relative to their incomes, tougher affordability pressures, uncertainty in the jobs market due to AI, and likely an ongoing shortage of housing supply. That’s if another global shock doesn’t intervene before then.”

-- ENDS --

Read our latest National Mortgage Insights Report

See the key trends in Australia's home loan market.

Download the National Mortgage Insights Report for free

Media/journalist enquiries:

Need a data breakdown by state, age or income — or have an idea for a consumer question? Contact our Head of PR: Megan Birot at megan@money.com.au.

Our expert home lending & property commentators

Nick Burgess, Senior Mortgage Broker

Nick is an experienced Senior Mortgage Broker at Money.com.au. He’s dedicated to guiding clients through their property investment journey. He takes the time to understand each client's unique circumstances, offering personalised solutions that go beyond just interest rates and terms. Guided by the philosophy, "Don’t find customers for your products, find products for your customers," Nick combines his extensive expertise with empathy to provide reliable, thoughtful support.

Alex Dore, Senior Mortgage Broker

Alex Dore is a Senior Mortgage Broker at Money.com.au, bringing over a decade of experience in lending with major Australian banks like CBA, NAB, and Westpac. Passionate about providing top-notch, customer-focussed service, Alex works with both businesses and individuals to meet their financial needs. Alex is dedicated to staying up-to-date with the latest industry trends and mortgage products, ensuring clients receive the most informed and effective recommendations for their unique situations.

Deborah Hays, Senior Mortgage Broker

Debbie Hays is a Senior Mortgage Broker and Finance Specialist at Money.com.au, with more than 25 years of experience in the finance industry. Known for her friendly and approachable nature, Debbie is committed to understanding each client’s unique financial goals. This dedication has helped her build strong, trusting relationships with a wide range of clients. Debbie believes every client deserves personalised attention and aims to exceed expectations at every opportunity. In recognition of her expertise and outstanding customer service, Debbie was named one of the Mortgage Professional Australia (MPA) Elite Women of 2024.